Trump family crypto profits top $1b, UK targets 65k investors, OpenSea sets token launch | Weekly Recap

PositiveCryptocurrency

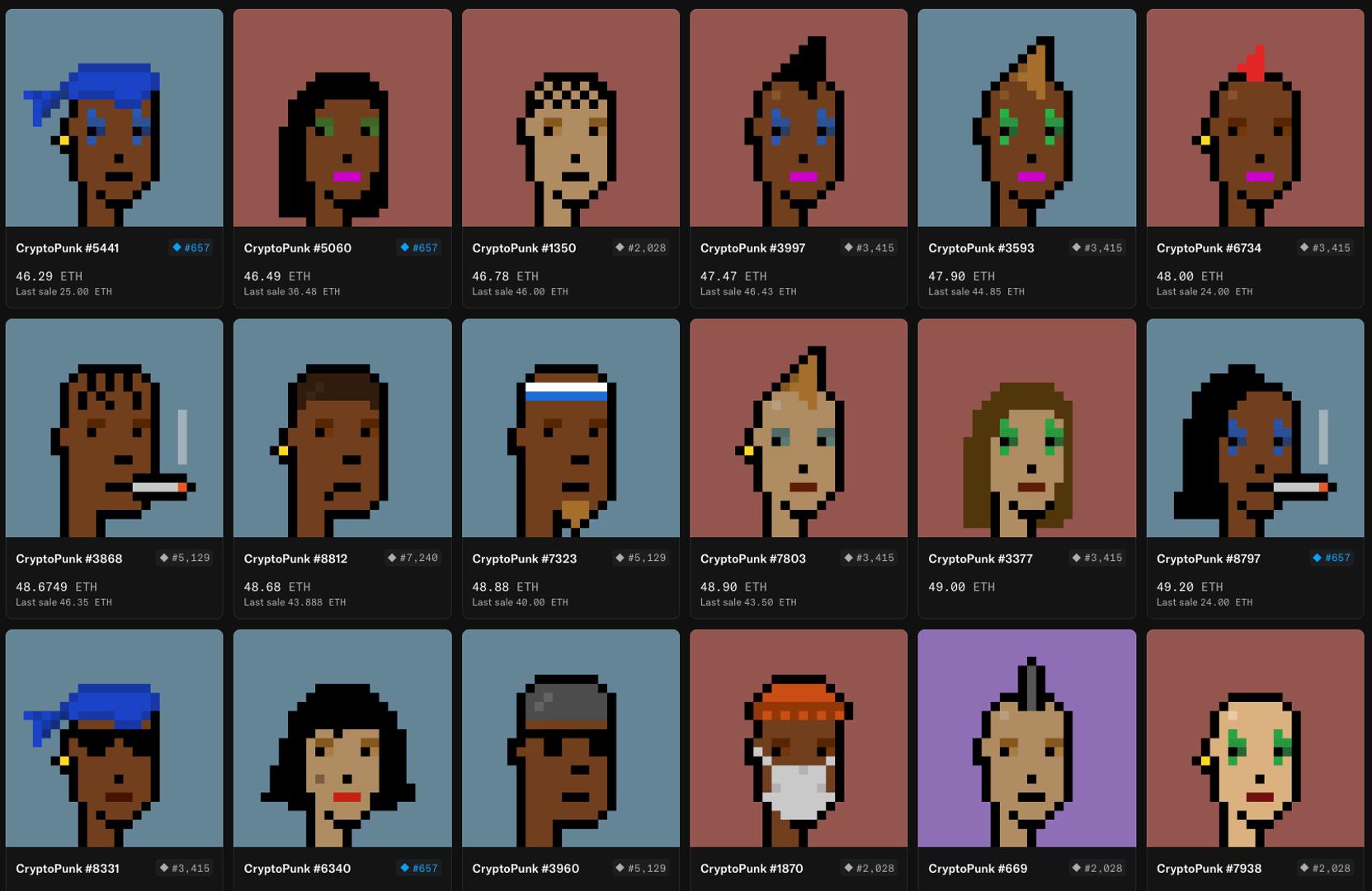

In this week's recap, we see a surge in the Trump family's crypto profits, surpassing $1 billion, highlighting the growing influence of cryptocurrency in mainstream finance. Meanwhile, the UK is ramping up regulatory enforcement, targeting 65,000 investors to ensure compliance and protect consumers. Additionally, OpenSea is set to launch its new token, which could reshape the NFT marketplace. These developments are significant as they reflect the evolving landscape of digital assets and the increasing scrutiny from regulators.

— Curated by the World Pulse Now AI Editorial System