OpenSea Plans To Launch SEA Token By Q1 2026 – Details

PositiveCryptocurrency

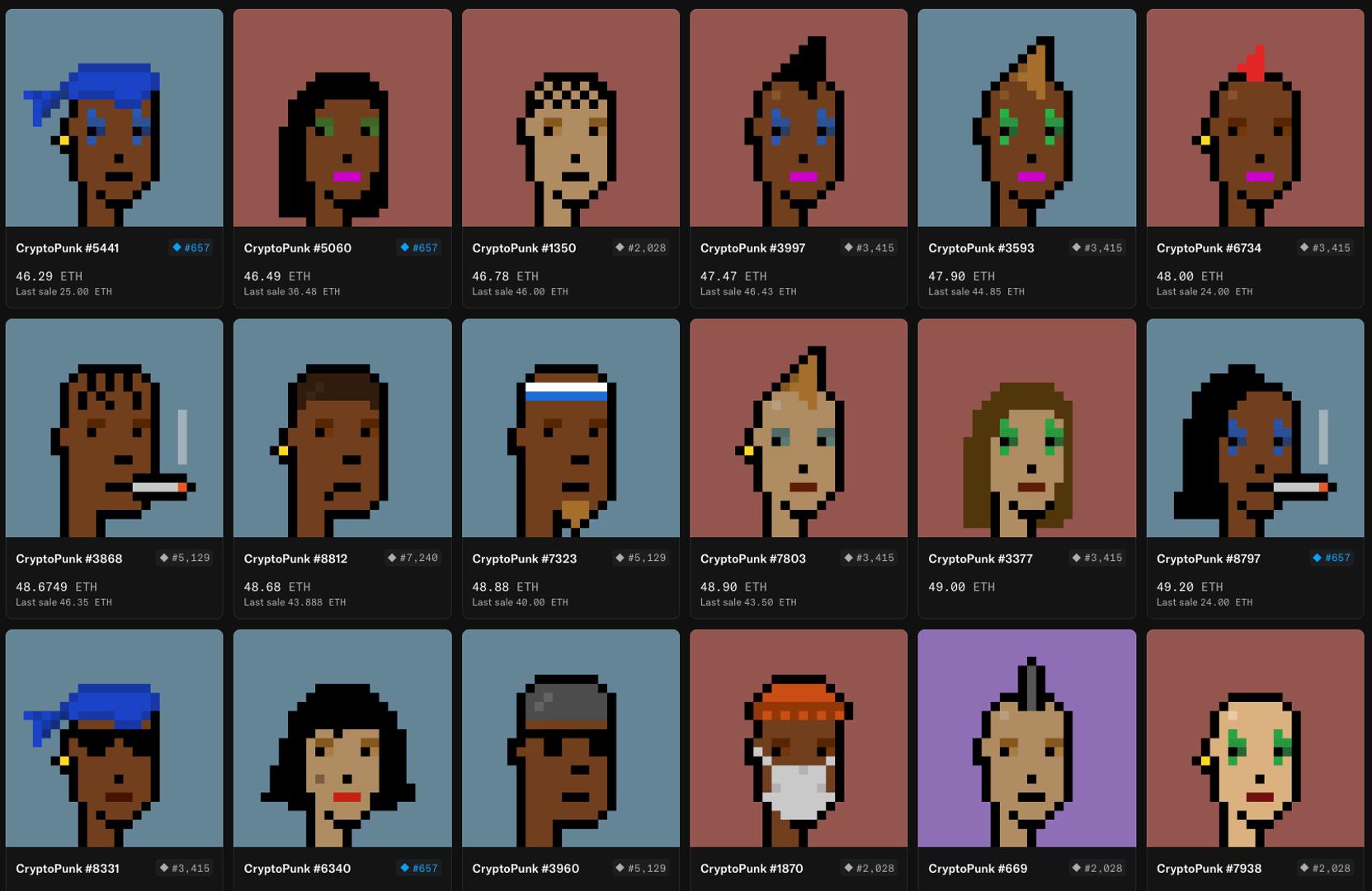

OpenSea, the popular NFT marketplace, is gearing up to launch its own native token, SEA, by the first quarter of 2026. This move, announced by CEO Devin Finzer, marks a significant step in OpenSea's evolution into a comprehensive platform for all blockchain trading activities. The introduction of the SEA token is expected to enhance user engagement and streamline transactions, making it a noteworthy development in the cryptocurrency space.

— Curated by the World Pulse Now AI Editorial System