Bitcoin Cash Rallies to Nearly $650, Highest Level Since April 2024

PositiveCryptocurrency

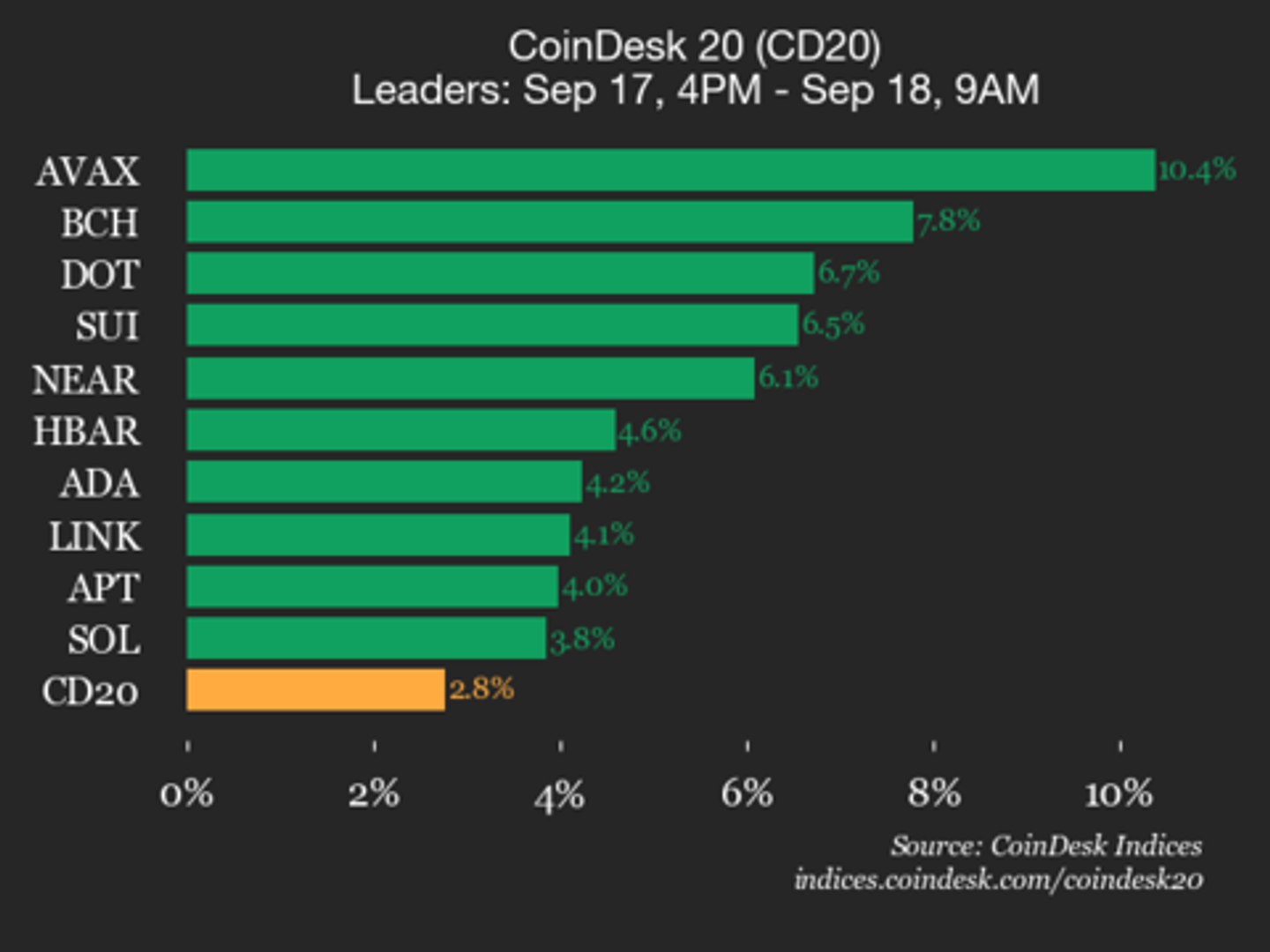

Bitcoin Cash has surged to nearly $650, marking its highest level since April 2024. This rally is attributed to a shift in market sentiment following the Federal Reserve's recent rate cut and growing expectations for quicker approvals of cryptocurrency ETFs in the U.S. This is significant as it reflects increasing investor confidence in the crypto market, potentially leading to more widespread adoption and investment.

— Curated by the World Pulse Now AI Editorial System