Ripple chief technology officer to step back, join board

PositiveCryptocurrency

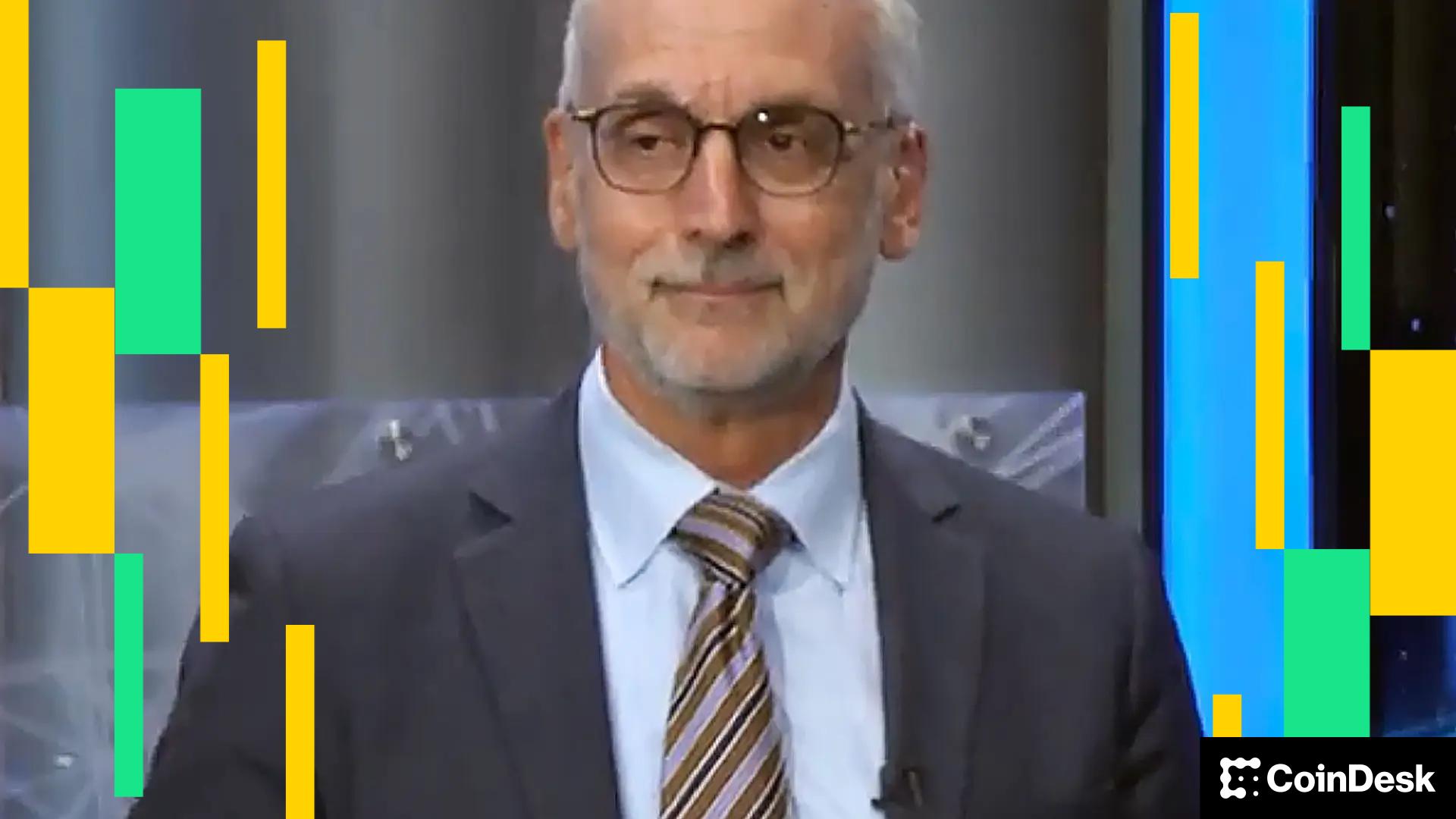

David Schwartz, the chief technology officer of Ripple, is stepping back from his current role to join the board. Known for his significant contributions to the XRP Ledger, Schwartz's transition is seen as a positive move for both him and the company. This change highlights Ripple's ongoing evolution in the cryptocurrency space and could signal new directions for the organization.

— Curated by the World Pulse Now AI Editorial System