Asia Morning Briefing: Cautious Calm Returns to BTC Markets as Traders Rebuild Risk

NeutralCryptocurrency

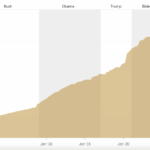

In the latest Asia morning briefing, a cautious calm has returned to Bitcoin markets as traders begin to rebuild their risk appetite. This shift is significant as it indicates a potential stabilization in the volatile cryptocurrency landscape, which could attract more investors looking for opportunities. Understanding these market dynamics is crucial for anyone involved in crypto trading, as it reflects broader economic sentiments and investor confidence.

— Curated by the World Pulse Now AI Editorial System