Stellar’s December Outlook Brightens as Network Use Cases Grow, but Major Resistance Still Looms

NeutralCryptocurrency

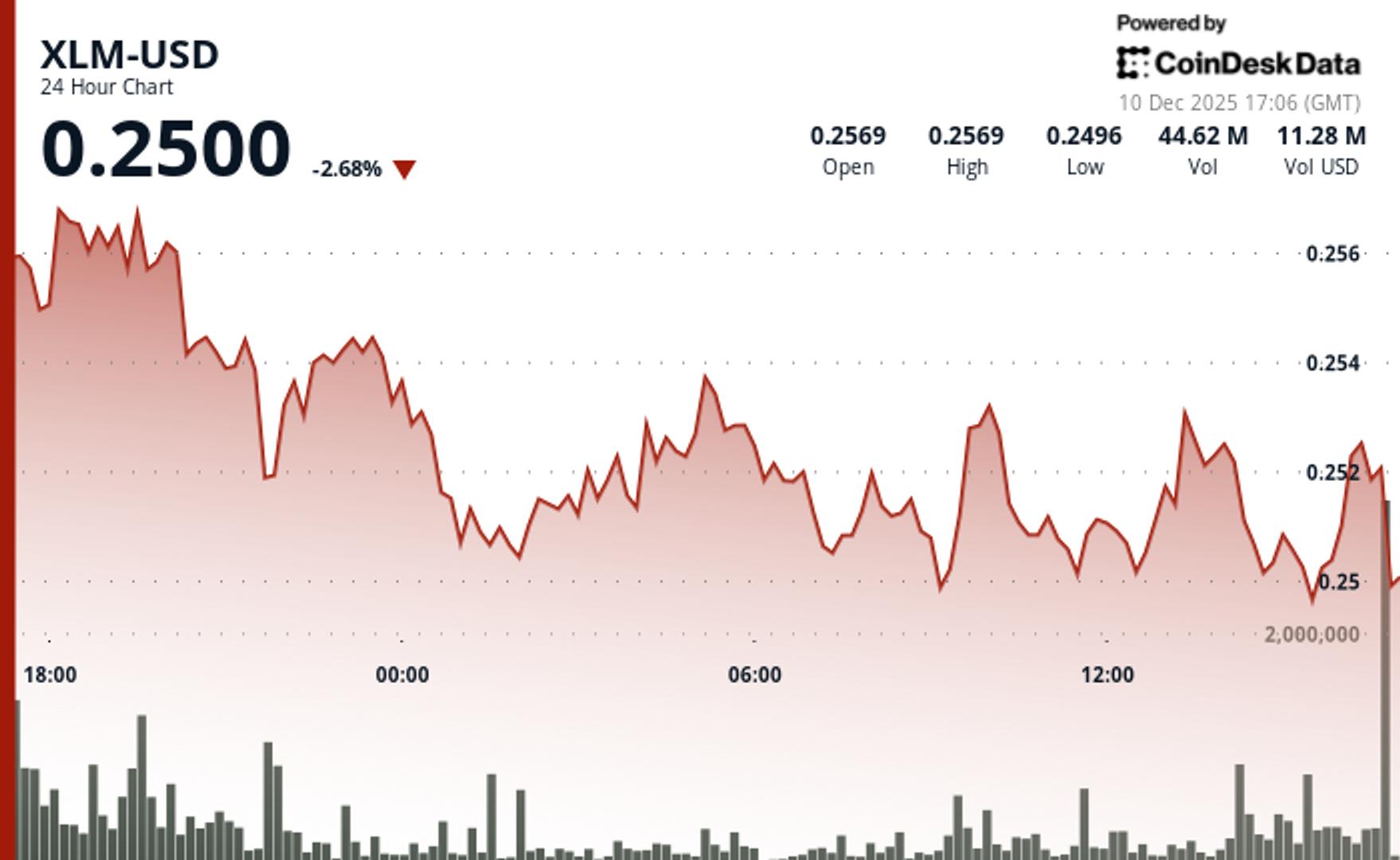

- Stellar's XLM has seen a recent uptick of approximately 4% as it enters December, driven by new payment integrations and institutional pilots that highlight the network's growing utility. However, the token remains near a critical long-term support level, creating uncertainty among traders regarding its potential recovery or further decline.

- The recent developments, particularly U.S. Bank's selection of the Stellar network for a stablecoin pilot, underscore the increasing institutional interest in Stellar's capabilities. This initiative aims to enhance transaction efficiency and security, aligning with broader trends in digital asset adoption.

- The current market dynamics reflect a tension between the strengthening fundamentals of Stellar's ecosystem and its fragile price structure. As institutional interest grows, evidenced by rising trading volumes and partnerships, the path forward for XLM remains uncertain, with traders closely monitoring its performance against key resistance levels.

— via World Pulse Now AI Editorial System