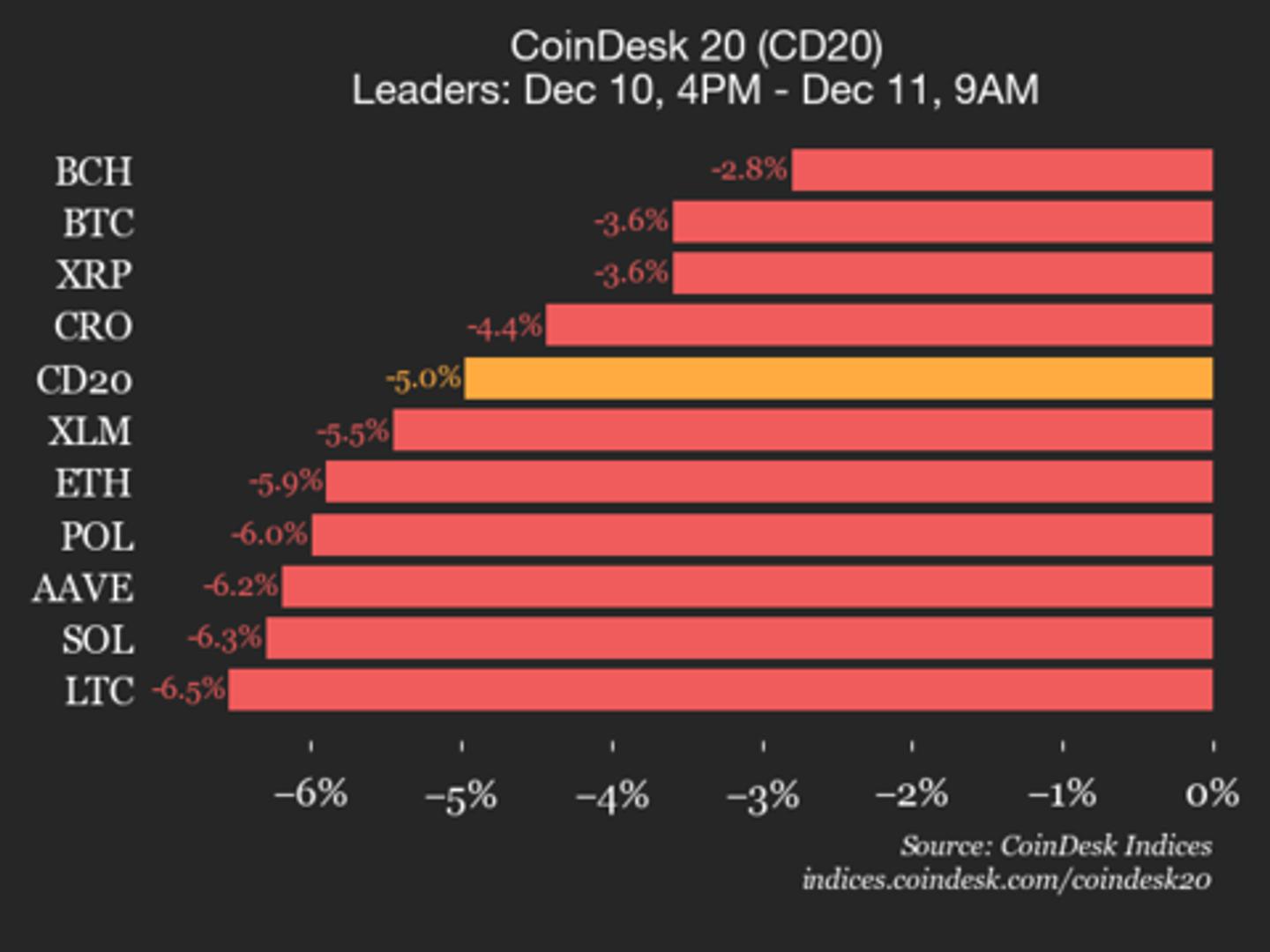

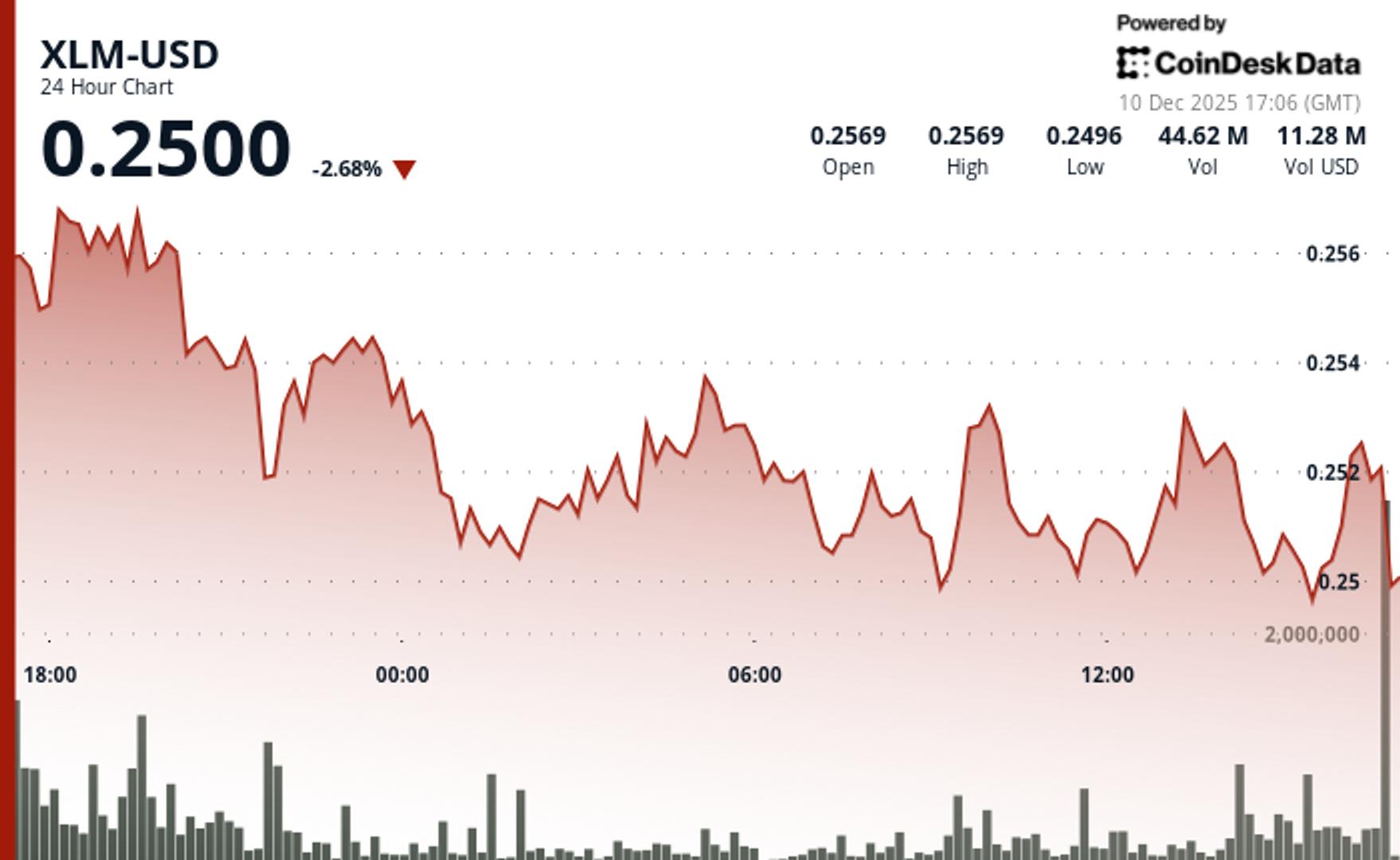

Stellar Edges Higher to $0.251 Despite Altcoin Market Apathy

PositiveCryptocurrency

- Stellar's XLM has seen a 2.6% increase, reaching $0.251, as trading volume surged 19% above weekly averages, indicating a consolidation around the critical $0.25 support level. This uptick follows U.S. Bank's selection of the XLM network for a stablecoin pilot program, highlighting a growing interest in digital currencies.

- The increase in XLM's value is significant as it reflects a positive response from the market, particularly in light of institutional interest and the ongoing exploration of digital assets by major financial institutions like U.S. Bank.

- This development occurs amidst a broader cryptocurrency market that has shown mixed results, with other tokens also experiencing fluctuations. The recent performance of Stellar suggests a potential shift in investor sentiment, as institutional partnerships may pave the way for increased adoption and stability in the cryptocurrency landscape.

— via World Pulse Now AI Editorial System