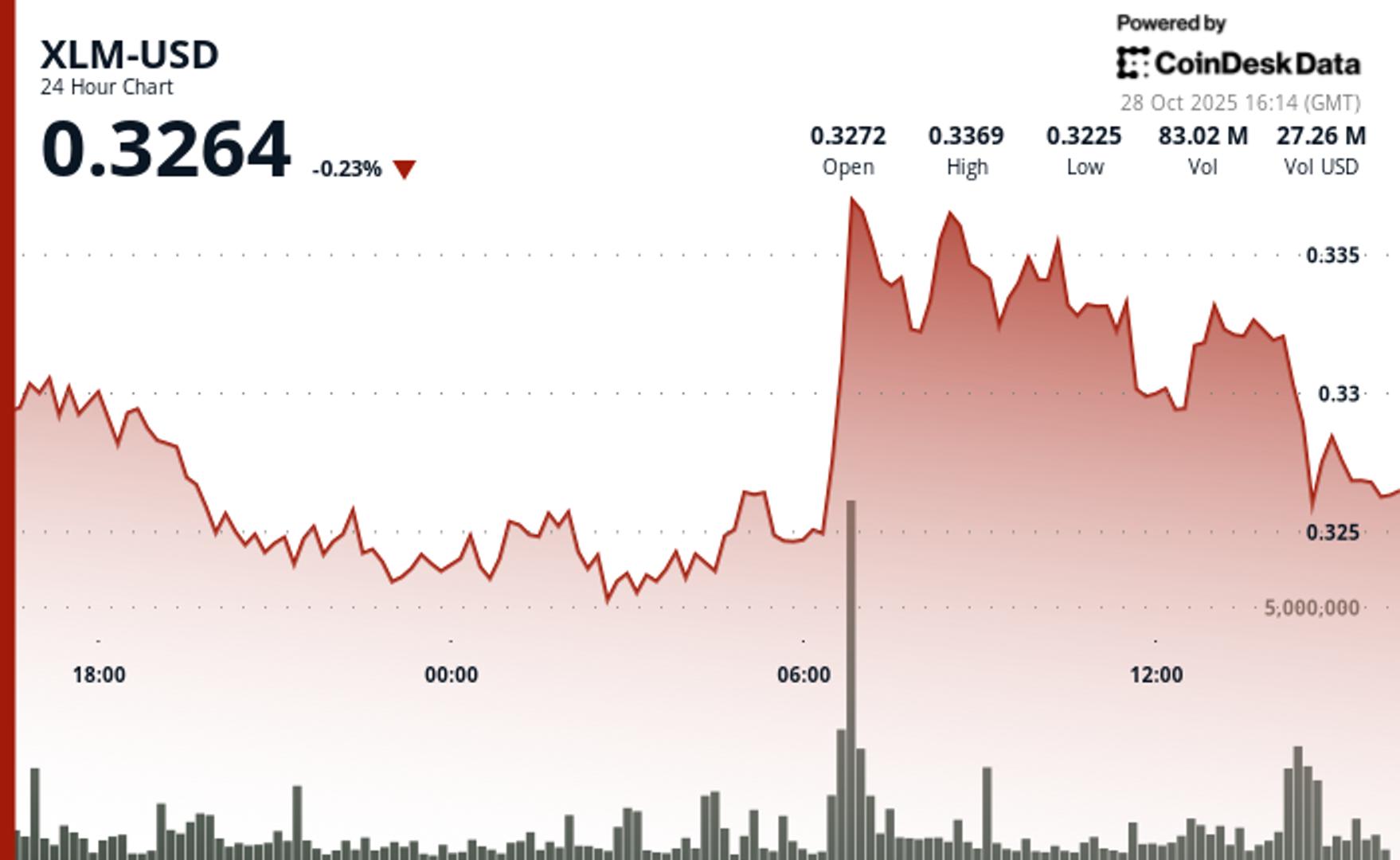

XLM Gains 2.3% to $0.3314 as Payment Networks Drive Institutional Interest

PositiveCryptocurrency

XLM has seen a notable increase of 2.3%, reaching $0.3314, largely driven by growing institutional interest in payment networks. This uptick is significant as it reflects a broader acceptance of cryptocurrencies in mainstream finance, indicating that more institutions are recognizing the potential of digital assets for transactions. As payment networks evolve, the demand for cryptocurrencies like XLM could continue to rise, making this a key moment for investors and the market.

— Curated by the World Pulse Now AI Editorial System