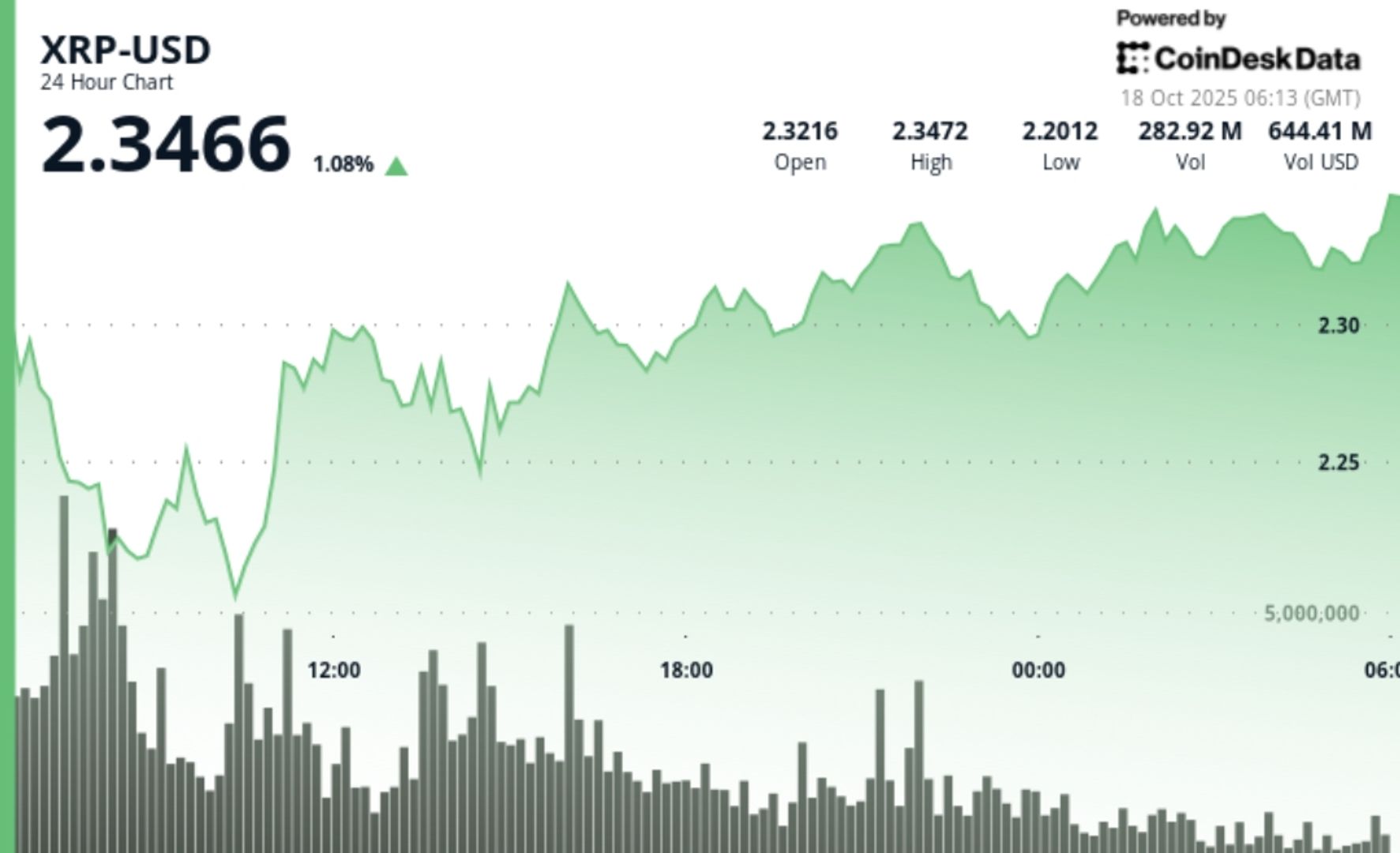

XRP Stabilizes After Early Dip, Traders Eye $2.40 Breakout

NeutralCryptocurrency

XRP has stabilized after an early dip, as traders are now focusing on a potential breakout at $2.40. This comes in the context of renewed fears over U.S.–China tariffs and a cautious approach ahead of upcoming SEC deadlines for spot XRP ETFs. The market's reaction to these developments is crucial, as it could influence XRP's price trajectory in the near future.

— Curated by the World Pulse Now AI Editorial System