Tether Looking to Launch Tokenized Gold Treasury Firm With Antalpha Raising $200M: Report

PositiveCryptocurrency

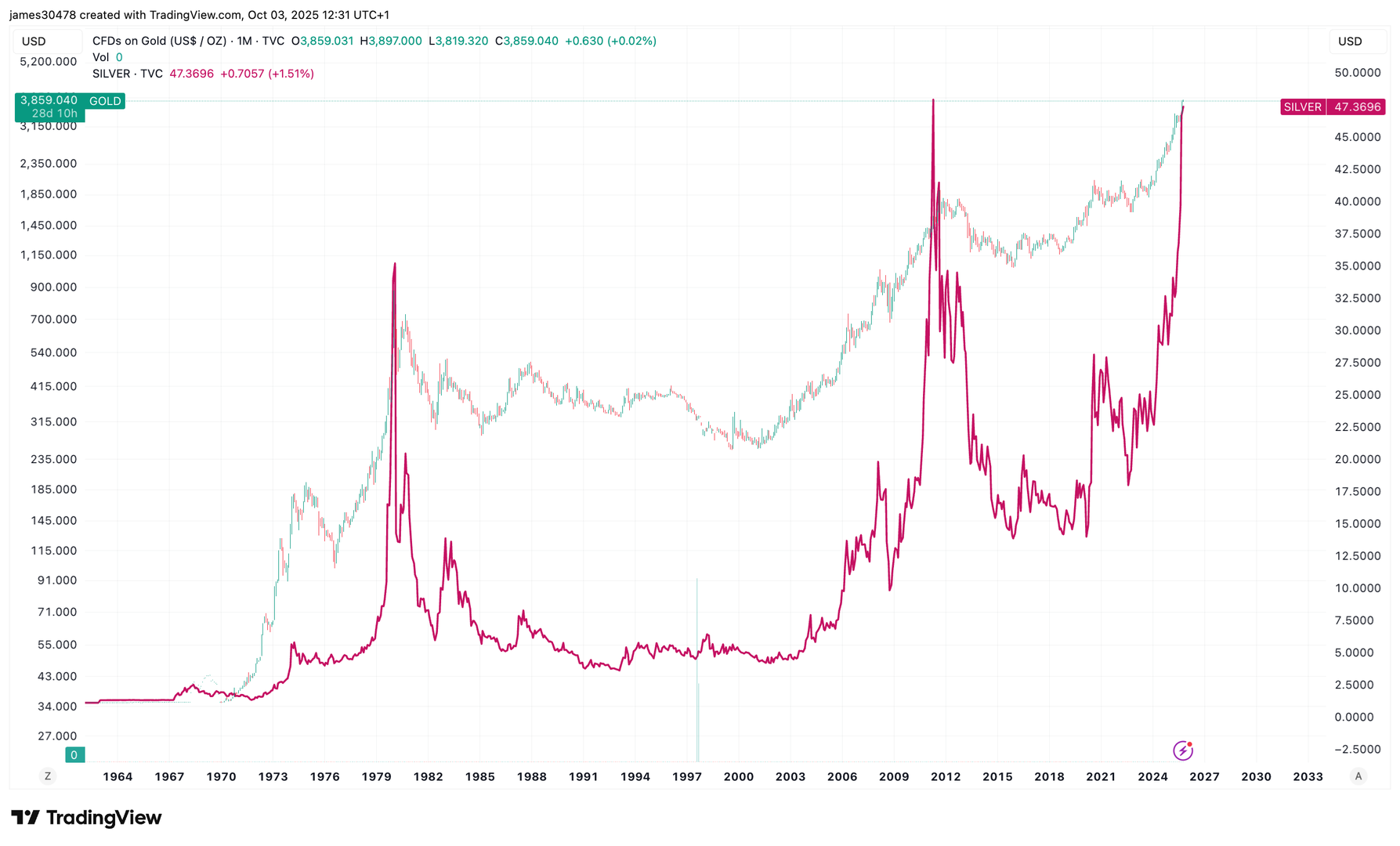

Tether is making strides in the cryptocurrency space by planning to launch a tokenized gold treasury firm in collaboration with Antalpha, which has recently raised $200 million. This initiative follows Antalpha's introduction of lending and infrastructure tools for Tether Gold (XAUT), highlighting a growing trend of integrating traditional assets like gold into the digital currency ecosystem. This move is significant as it could enhance the stability and appeal of cryptocurrencies, attracting more investors looking for secure options.

— Curated by the World Pulse Now AI Editorial System