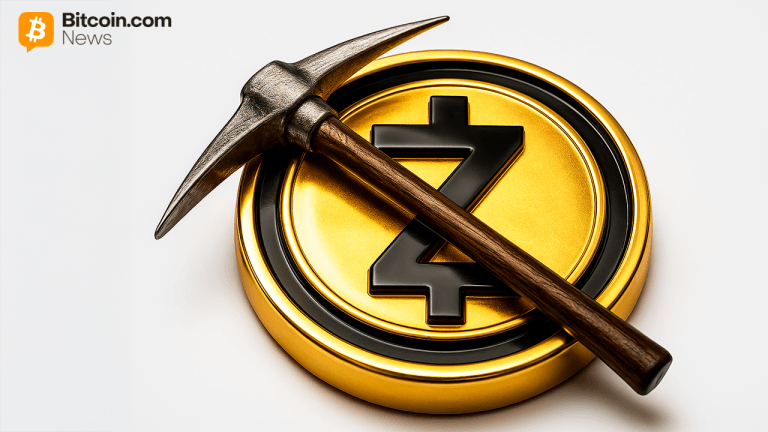

Zcash Hashrate Hits Record High as Miners Cash In on Rally

PositiveCryptocurrency

Zcash has reached a record high in hashrate, signaling a strong interest from miners who are capitalizing on the recent price rally. This surge in mining activity not only reflects the growing confidence in Zcash as a cryptocurrency but also highlights the potential for increased network security and transaction efficiency. As more miners join the network, it could lead to a more robust ecosystem, benefiting both investors and users alike.

— Curated by the World Pulse Now AI Editorial System