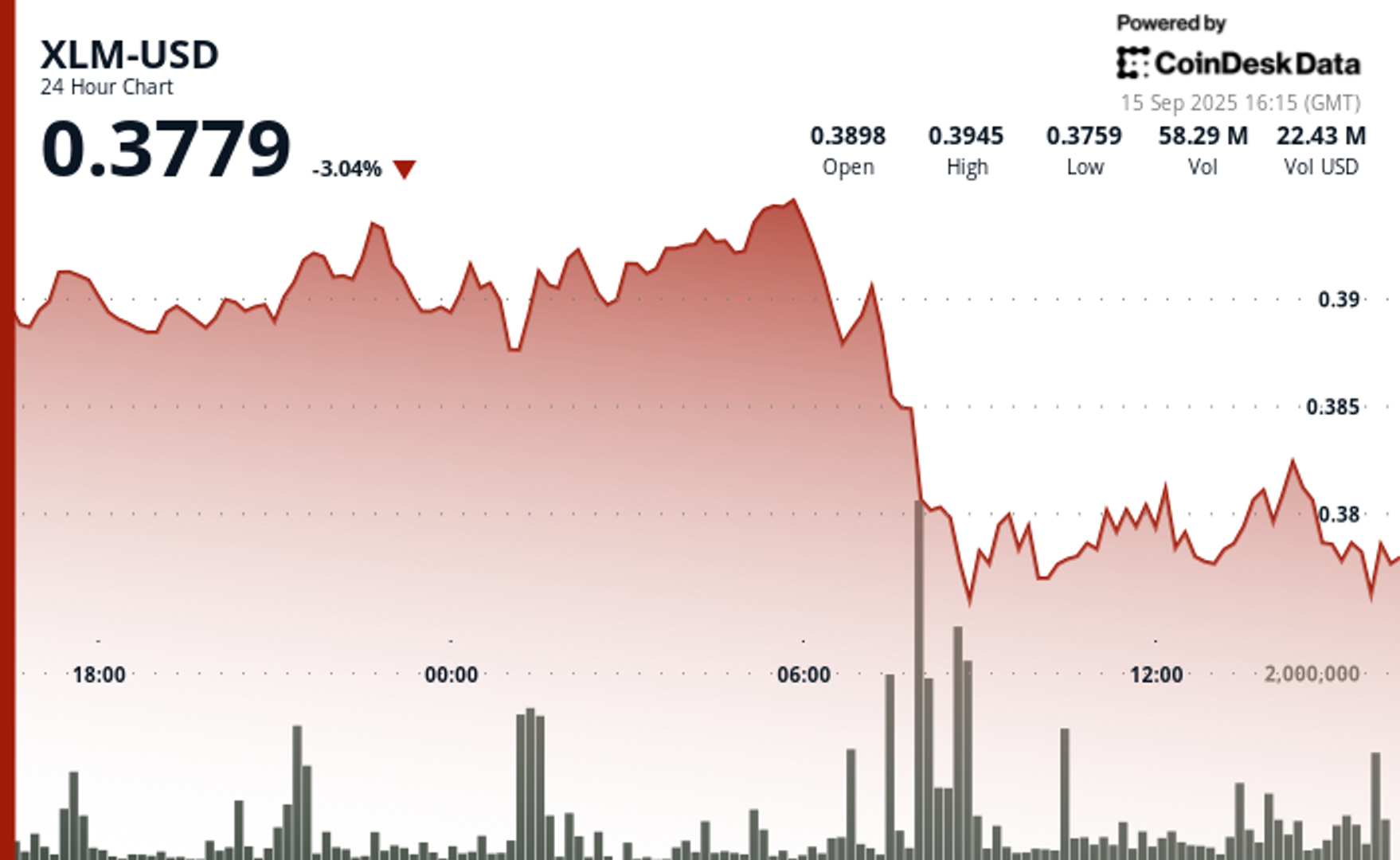

XLM Sees Heavy Volatility as Institutional Selling Weighs on Price

NegativeCryptocurrency

Stellar’s XLM token dropped 3% due to institutional selling, although there were signs of a brief recovery during the day.

Editor’s Note: This matters because fluctuations in cryptocurrency prices can impact investor confidence and market stability. Institutional selling often signals a lack of confidence in the asset, which can lead to further declines.

— Curated by the World Pulse Now AI Editorial System