BTC Holds Steady as Fed Rate Cut Looms, Rising Treasury Yields Suggest Caution: Analysts

NeutralCryptocurrency

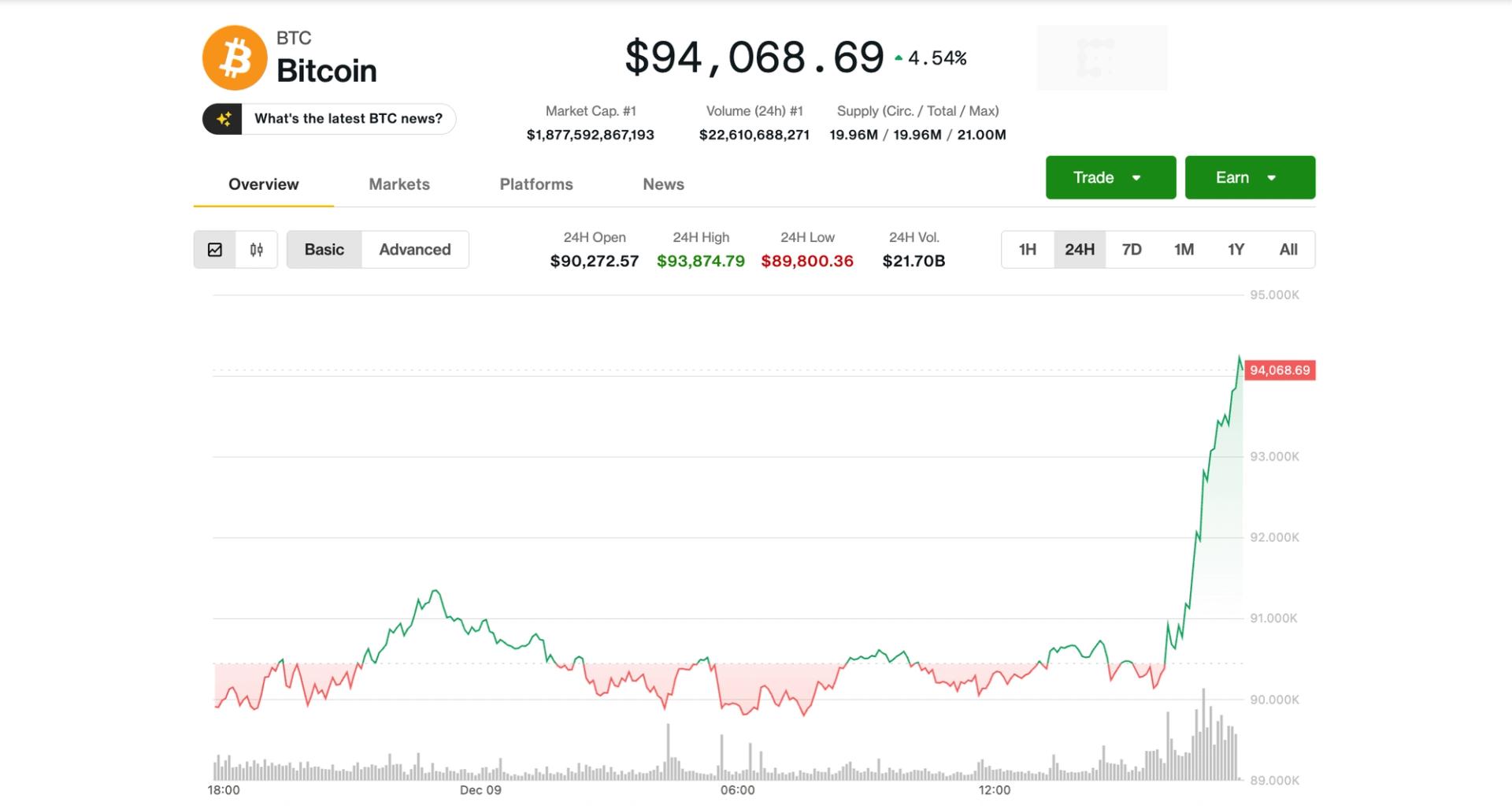

- Bitcoin (BTC) has maintained a steady position as traders anticipate a potential interest rate cut by the Federal Reserve, with rising Treasury yields suggesting a cautious market outlook. Analysts are closely monitoring these developments as they could significantly impact cryptocurrency prices.

- The stability of BTC amidst these economic indicators is crucial for investors and traders, as it reflects market sentiment and expectations regarding future monetary policy. The Fed's decisions could either bolster or hinder the cryptocurrency's performance in the coming weeks.

- This situation highlights the ongoing volatility in both cryptocurrency and traditional markets, as traders brace for potential shifts in U.S. monetary policy. The fluctuating odds of a December rate cut, alongside the unchanged U.S. 10-year yield, indicate a complex interplay of factors influencing investor confidence and market dynamics.

— via World Pulse Now AI Editorial System