BTC poised for December recovery on ‘macro tailwinds,' Fed rate cut: Coinbase

PositiveCryptocurrency

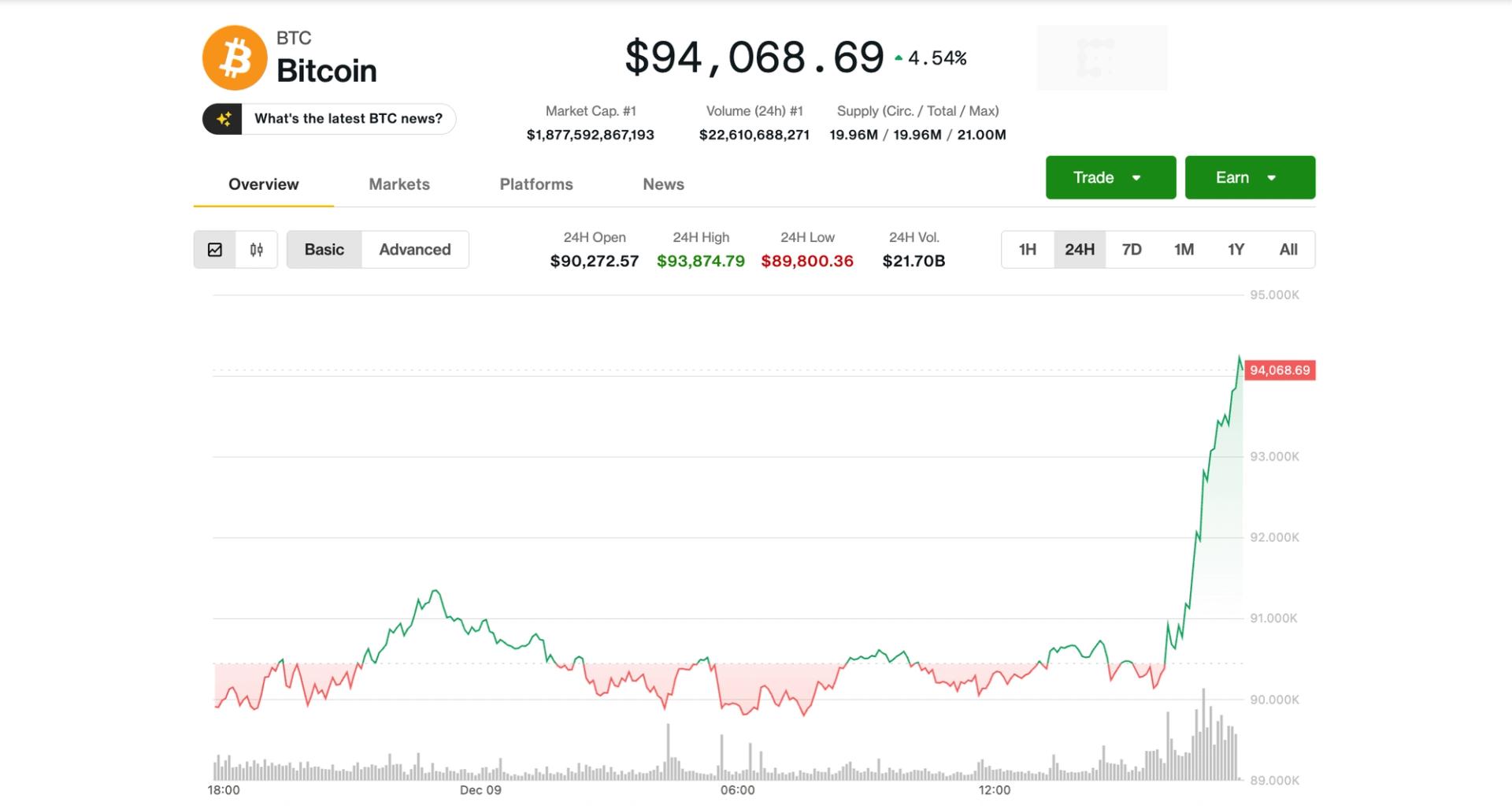

- Coinbase has indicated that Bitcoin (BTC) is positioned for a recovery in December, driven by increased global M2 liquidity and anticipated lower interest rates. However, comments from Fed Chair Powell may temper this optimism, suggesting potential limitations on BTC's upward movement.

- This development is significant for Coinbase as it reflects a broader market sentiment that could influence investor behavior and trading strategies. A recovery in Bitcoin's price could enhance Coinbase's trading volume and overall market presence.

- The current environment highlights a complex interplay between macroeconomic factors and cryptocurrency valuations. While optimism grows among Bitcoin enthusiasts regarding a potential Fed rate cut, recent fluctuations in Bitcoin's price and market dynamics underscore the volatility and uncertainty inherent in the cryptocurrency sector.

— via World Pulse Now AI Editorial System