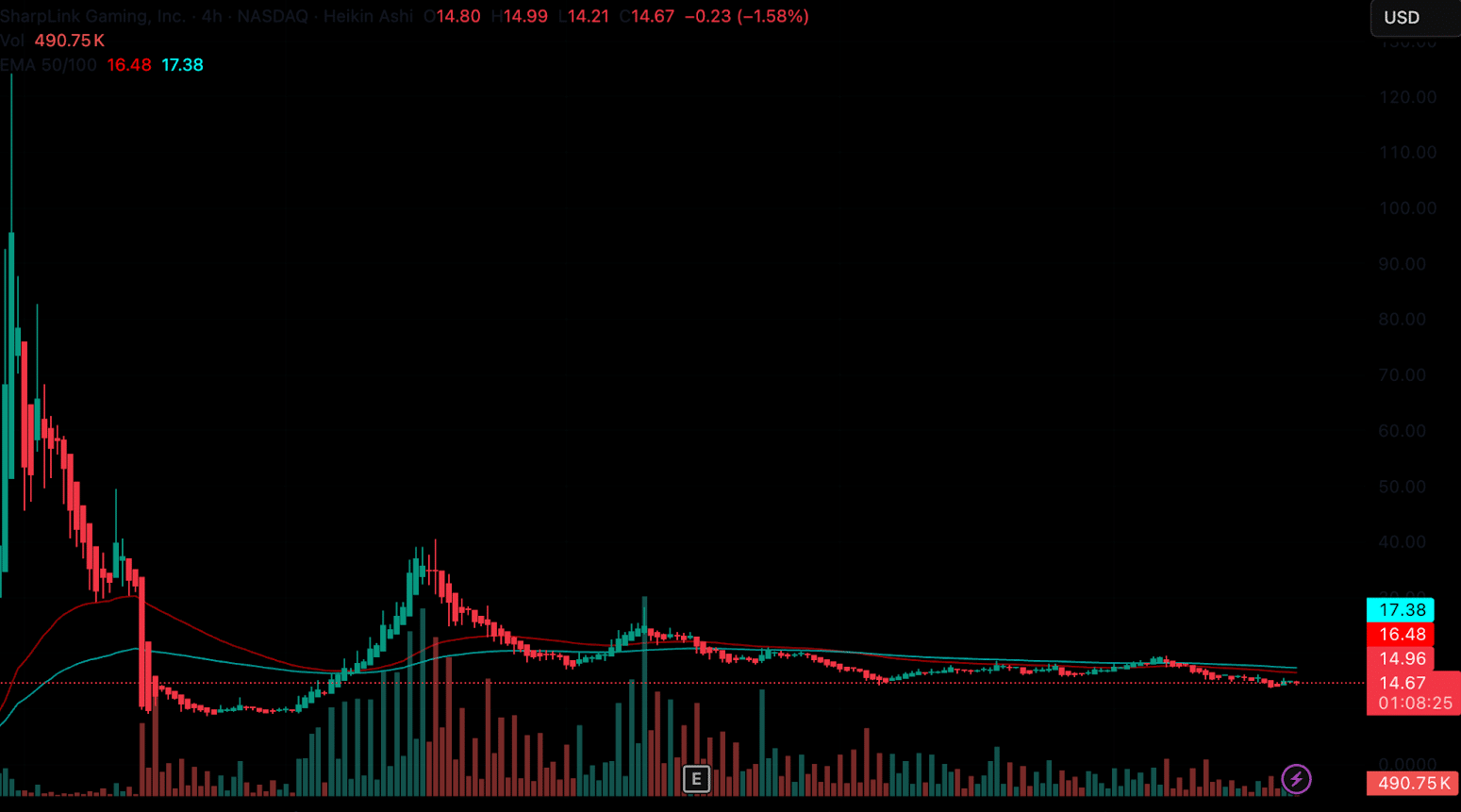

Aave Rebounds Above $230 Confirming Double-Bottom Reversal

PositiveCryptocurrency

Aave has shown a strong rebound, climbing above $230, which confirms a double-bottom reversal pattern. This is significant as it indicates a potential recovery in the cryptocurrency market, suggesting that investor confidence may be returning. Such movements can attract more traders and lead to increased market activity, making it an important development for those following cryptocurrency trends.

— Curated by the World Pulse Now AI Editorial System