DOGE Price Breaks Key Support: Is Alt Run No More?

NegativeCryptocurrency

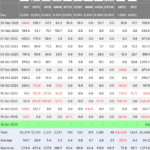

DOGE's recent price action has raised concerns among its holders as it has broken key support levels. This situation prompts questions about whether DOGE will continue to be a significant player in future altcoin runs or if it will be left behind. The historical context of DOGE's performance during past bull runs adds to the uncertainty, making it a critical moment for investors.

— Curated by the World Pulse Now AI Editorial System