Crypto for Advisors: Crypto’s Role in Portfolios

PositiveCryptocurrency

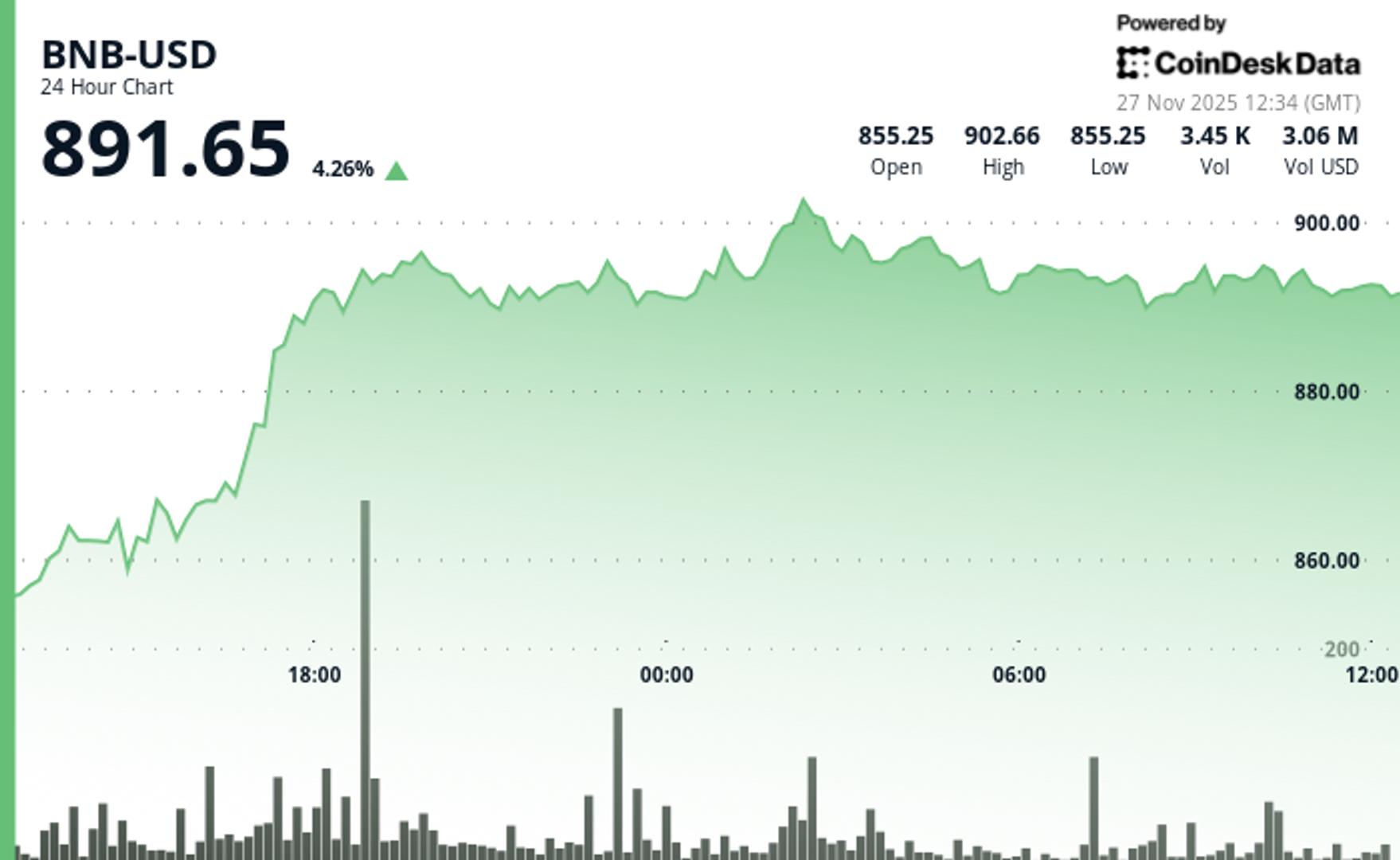

- The role of cryptocurrency in diversified portfolios is increasingly recognized, emphasizing the importance of managing volatility, establishing clear investment mandates, and maintaining risk discipline. Active investing and broader diversification strategies are being advocated to enhance portfolio resilience against market fluctuations.

- This development is significant as it reflects a growing acceptance among financial advisors and investors of cryptocurrencies as viable assets. By integrating crypto into portfolios, advisors can potentially improve returns while managing associated risks, aligning with modern investment strategies.

- The ongoing evolution of crypto products, including the maturation of crypto ETFs and the rise of corporate treasuries investing in digital assets, illustrates a broader trend towards institutional adoption of cryptocurrencies. This shift is marked by mixed outcomes, highlighting both the potential rewards and inherent risks of crypto investments in a volatile market landscape.

— via World Pulse Now AI Editorial System