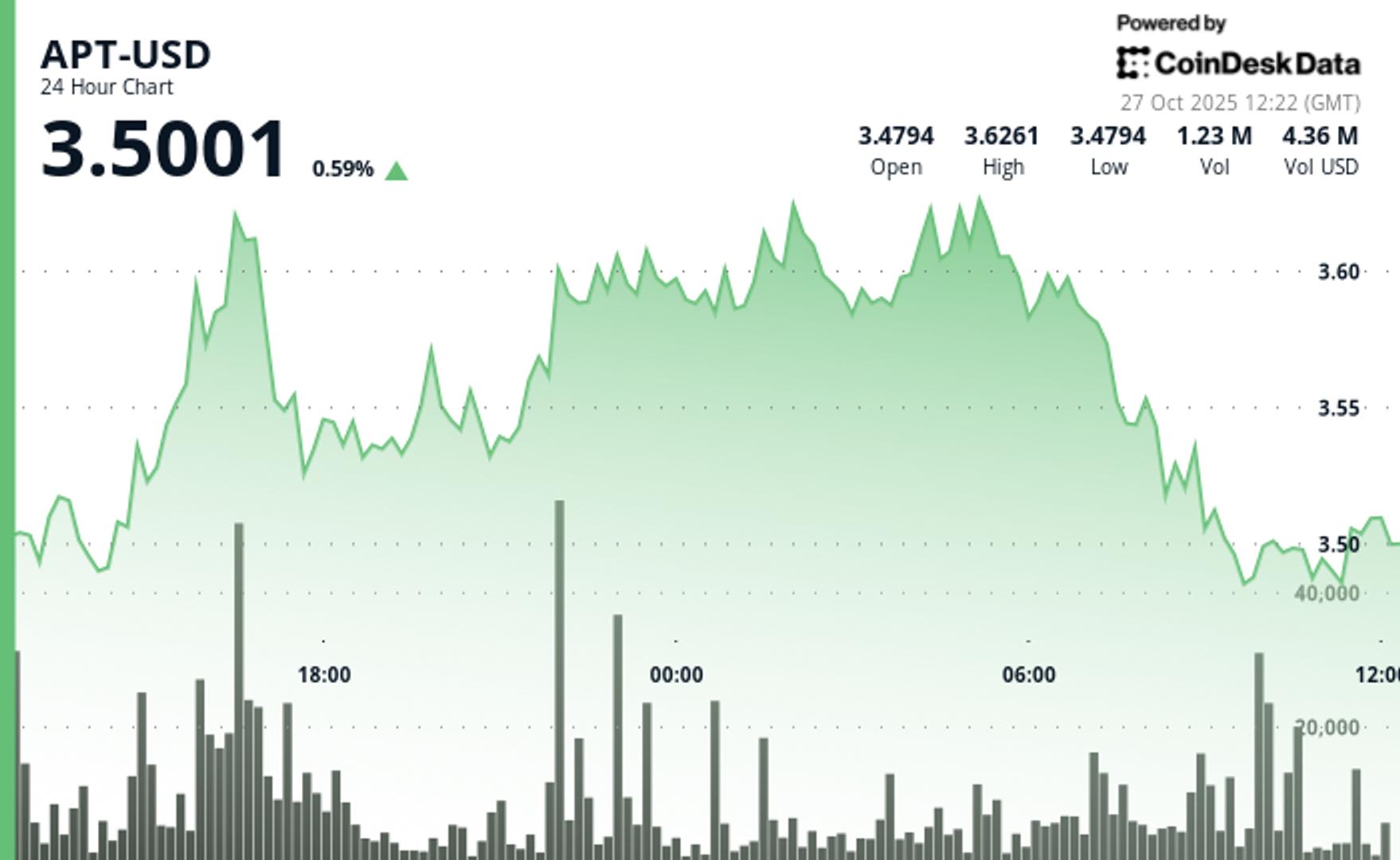

Whale deposits $3.72M USDC into Hyperliquid, opens $27.7M BTC long

PositiveCryptocurrency

A significant whale has deposited $3.72 million USDC into the decentralized trading platform Hyperliquid and opened a $27.7 million long position in Bitcoin. This surge in whale activity indicates a growing interest in decentralized platforms for high-leverage crypto trading, which could shift market dynamics and attract more traders to these innovative platforms.

— Curated by the World Pulse Now AI Editorial System