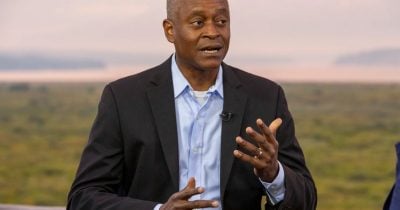

Bitcoin At $3.4 Million? Arthur Hayes Thinks It’s Coming

PositiveCryptocurrency

Arthur Hayes, the former CEO of BitMEX, has made a bold prediction that Bitcoin could soar to $3.4 million by 2028. This forecast is based on significant assumptions regarding credit growth and policy changes, particularly the Federal Reserve's potential role in purchasing a large portion of new Treasury debt. If Hayes' projections hold true, it could signal a transformative period for Bitcoin and the broader financial landscape, making it a topic of keen interest for investors and analysts alike.

— Curated by the World Pulse Now AI Editorial System