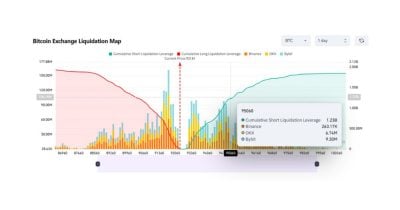

$1.2B in shorts set to liquidate if Bitcoin hits 95,076

PositiveCryptocurrency

- A significant surge in Bitcoin's price could lead to the liquidation of approximately $1.2 billion in short positions if it reaches $95,076, potentially triggering forced buy-ins that would amplify market volatility and drive prices even higher.

- This development is crucial as it highlights the precarious nature of leveraged trading in the cryptocurrency market, where a rapid price increase can lead to substantial losses for those betting against Bitcoin, thereby affecting overall market dynamics.

- The current situation reflects ongoing volatility in the cryptocurrency market, with contrasting sentiments among investors. While some anticipate further gains, others express concerns about potential downturns, particularly in light of external factors such as upcoming elections and economic indicators that could influence Bitcoin's trajectory.

— via World Pulse Now AI Editorial System