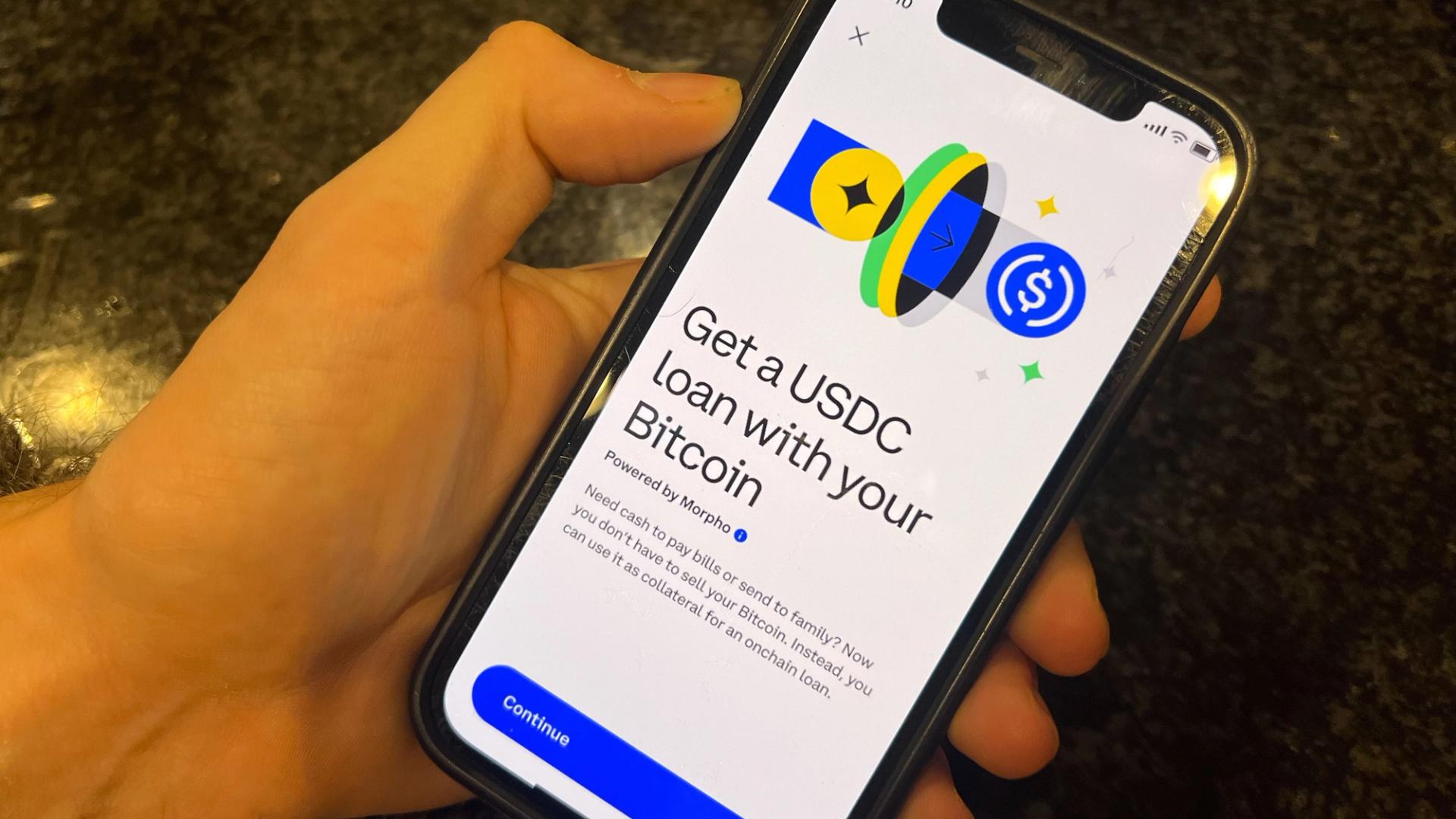

Coinbase taps DeFi to offer up to 10.8% yield on USDC holdings

PositiveCryptocurrency

Coinbase is making waves in the cryptocurrency world by integrating Morpho lending into its app, allowing users to earn impressive yields of up to 10.8% on their USDC holdings. This move not only enhances the earning potential for users but also signifies a growing trend of decentralized finance (DeFi) being embraced by mainstream platforms. It's a big step for Coinbase as it continues to innovate and provide more value to its customers.

— Curated by the World Pulse Now AI Editorial System