Hyperliquid Hits New All-Time High: Will Momentum Push HYPE Into a Higher Range?

PositiveCryptocurrency

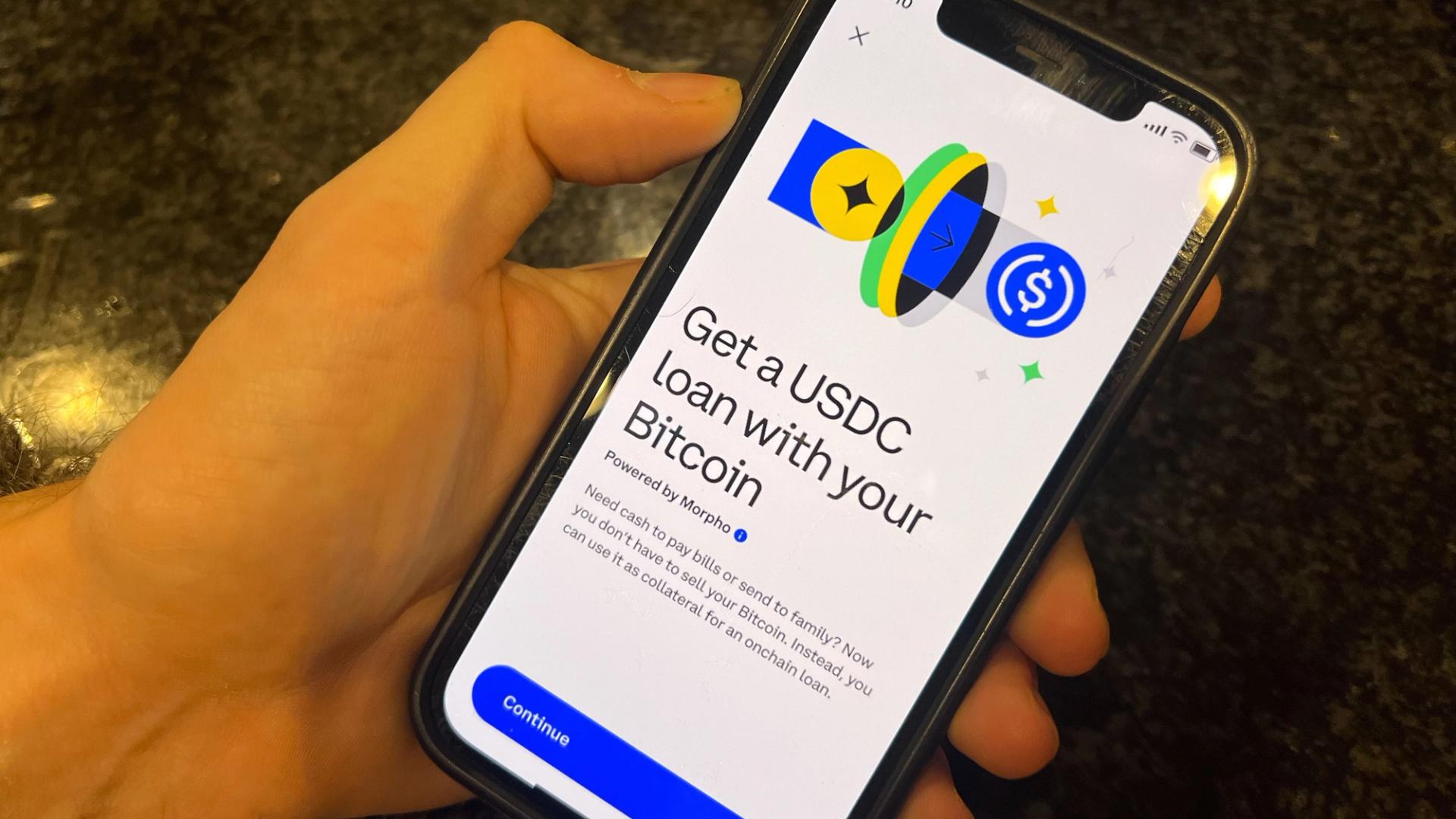

Hyperliquid's native token, HYPE, has reached a new all-time high, surging over 8% to nearly $58.77. This impressive rally follows a rebound from its previous record of $57.40 and brings it close to the significant $60 mark. The momentum is fueled by the successful integration of USDC and Circle's Cross-Chain Transfer Protocol, enhancing Hyperliquid's capabilities on the Ethereum platform. This development is crucial as it not only boosts investor confidence but also highlights the growing adoption of innovative technologies in the cryptocurrency space.

— Curated by the World Pulse Now AI Editorial System