House Of Doge Reveals Why Institutions Are Now Closely Watching Dogecoin

PositiveCryptocurrency

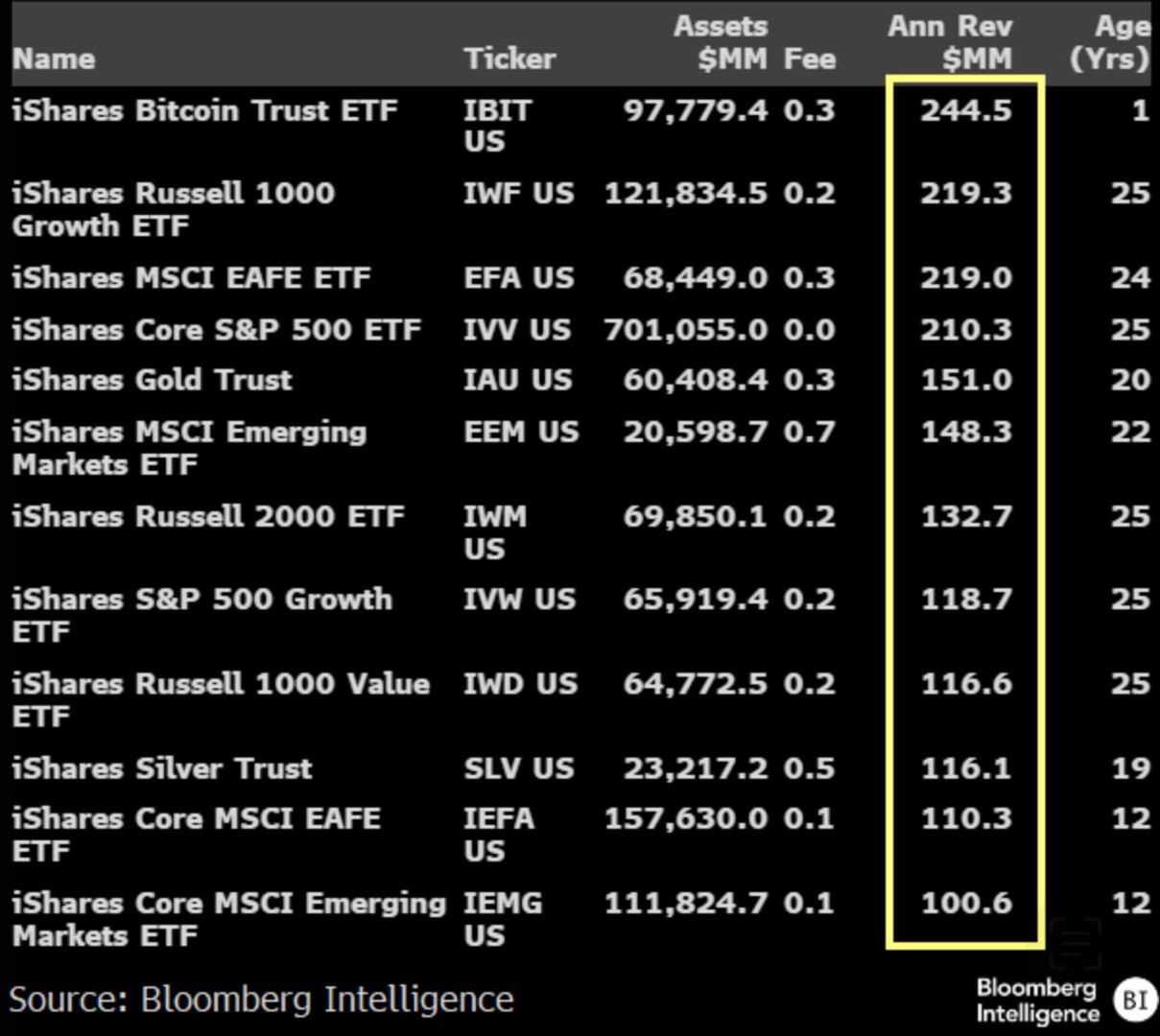

House of Doge has highlighted the growing institutional interest in Dogecoin, particularly with the recent filings for multiple Dogecoin Exchange-Traded Funds (ETFs). This shift marks a significant transformation for DOGE, which started as a meme, now being taken seriously alongside established cryptocurrencies like Solana and XRP. This trend is important as it indicates a broader acceptance of cryptocurrencies in traditional finance, potentially leading to increased stability and investment in the market.

— Curated by the World Pulse Now AI Editorial System