SharpLink Ether holdings near $1B in unrealized gains as ETH surges

PositiveCryptocurrency

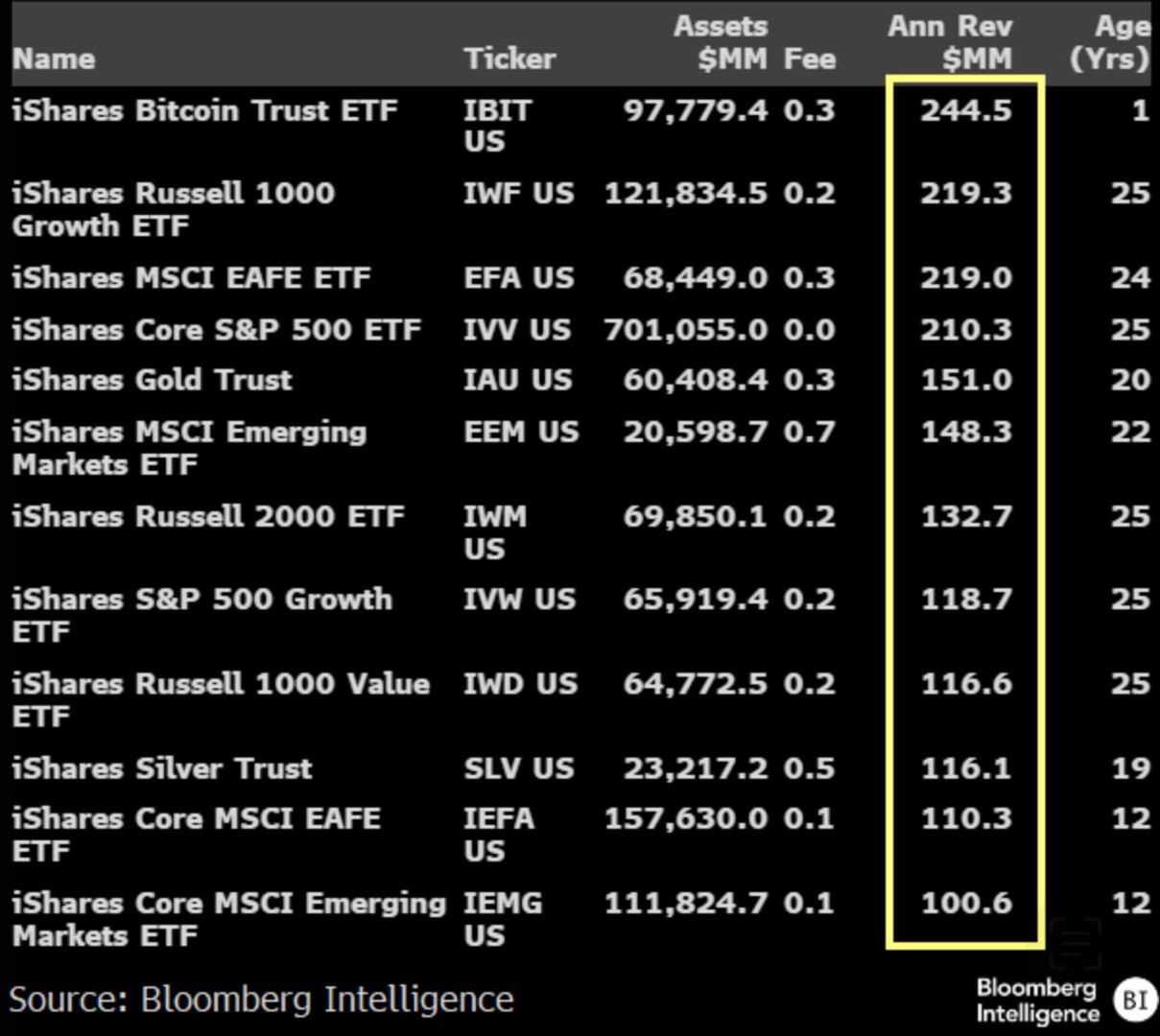

SharpLink is making headlines as its Ether holdings approach $1 billion in unrealized gains, thanks to a significant surge in ETH prices. This is noteworthy because it highlights the growing influence of corporate players in the cryptocurrency market, with treasury firms and ETFs now holding over 10% of ETH's total supply. SharpLink and BitMine are at the forefront of this accumulation, signaling a shift in how institutional investors view digital assets.

— Curated by the World Pulse Now AI Editorial System