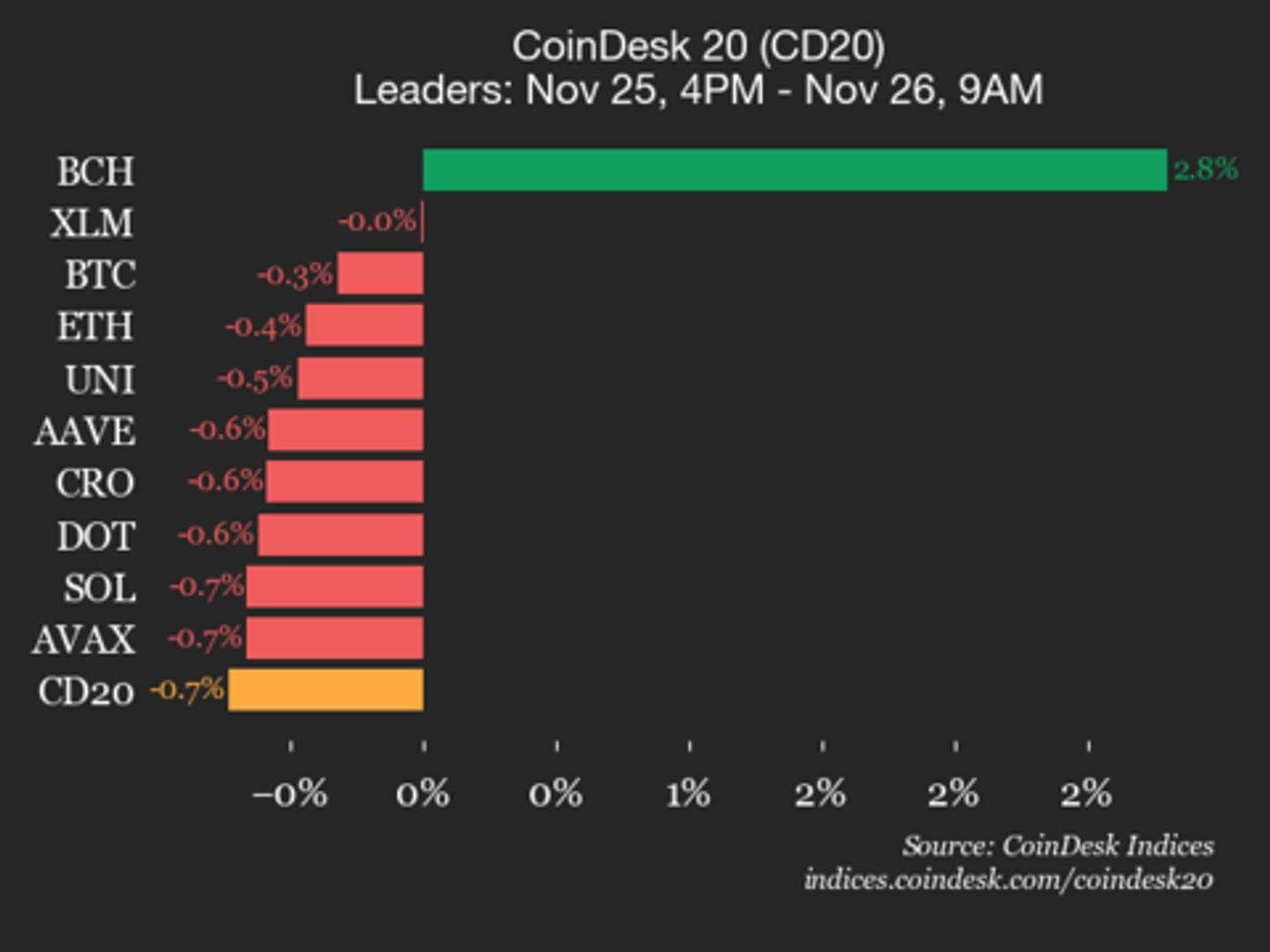

CoinDesk 20 Performance Update: Only Bitcoin Cash (BCH) Gains, Up 2.8%

NegativeCryptocurrency

- The CoinDesk 20 index has shown a negative trend, with Bitcoin Cash (BCH) being the only cryptocurrency to gain, increasing by 2.8%. In contrast, Internet Computer (ICP) fell by 3.4% and Litecoin (LTC) dropped by 1.7%, contributing to the overall decline of the index.

- This performance is significant as it highlights the ongoing volatility in the cryptocurrency market, where BCH's modest gain stands out against the backdrop of losses experienced by other major cryptocurrencies, indicating investor sentiment and market dynamics.

- The broader cryptocurrency landscape continues to face challenges, with many assets experiencing declines amid fluctuating market conditions. The recent performance of BCH may reflect a temporary divergence in investor interest, as other cryptocurrencies struggle, underscoring the unpredictable nature of the market.

— via World Pulse Now AI Editorial System