XRP Price Prediction After Rate Cut: Key Levels to Watch & Why $HYPER Could Be Next 1000x Crypto

NeutralCryptocurrency

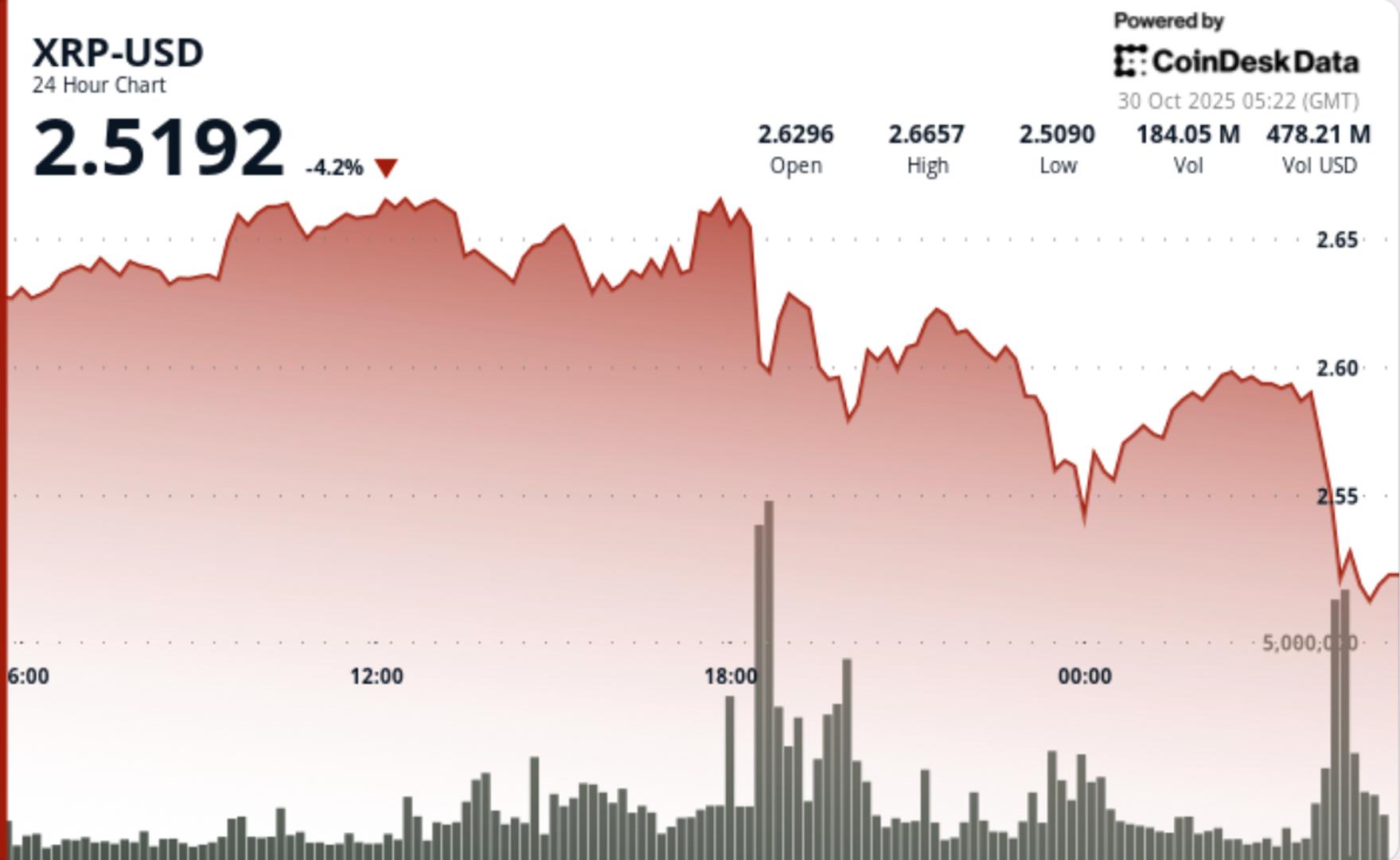

The recent rate cut by the Fed didn't boost crypto markets as many had expected, since it was largely anticipated. XRP's price is currently facing a resistance at $2.70, with potential for a breakout that could see it rise to $4.50 in the short term and $15 in the long term. Meanwhile, investors are showing interest in Bitcoin Hyper ($HYPER), which is being touted as a potential 1000x crypto, reflecting a growing trend towards utility-driven altcoins. This situation highlights the volatility and speculative nature of the crypto market.

— Curated by the World Pulse Now AI Editorial System