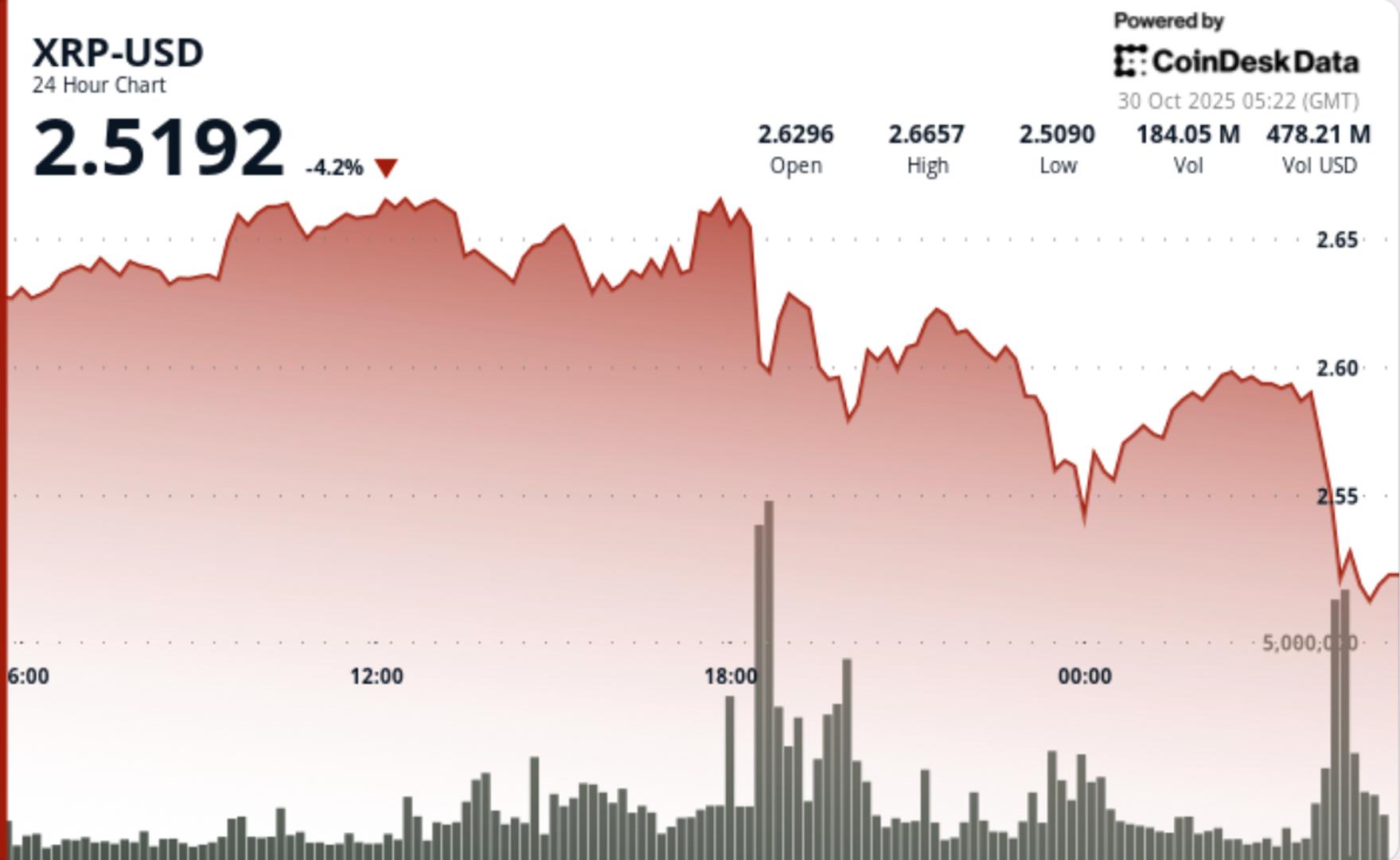

XRP Rejects $2.67 Breakout in Risk of Deeper Pullback as Fed Cuts Cause Bitcoin Slide

NegativeCryptocurrency

XRP has faced a setback, rejecting a breakout at $2.67, which raises concerns about a potential deeper pullback in the cryptocurrency market. This comes in the wake of recent Federal Reserve cuts that have also negatively impacted Bitcoin's value. Understanding these market dynamics is crucial for investors as they navigate the volatility and seek to make informed decisions.

— Curated by the World Pulse Now AI Editorial System