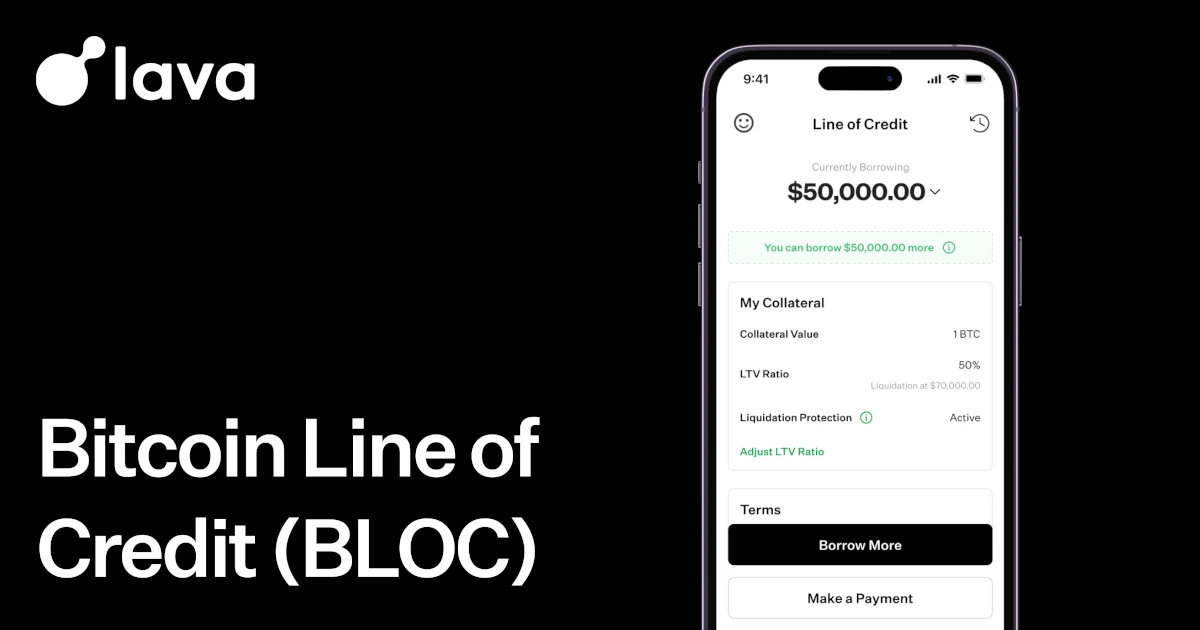

Hawkish Fed remarks drive $360M in crypto outflows but Solana ETFs shine

NegativeCryptocurrency

Recent comments from the Federal Reserve have led to a significant $360 million outflow from cryptocurrency investments, particularly affecting Bitcoin funds as investors react to ongoing policy uncertainties in the US. However, amidst this downturn, Bitwise's new Solana staking ETF has made a remarkable entrance, attracting strong inflows. This situation highlights the volatility in the crypto market and the contrasting performance of specific assets like Solana, which may indicate shifting investor preferences.

— Curated by the World Pulse Now AI Editorial System