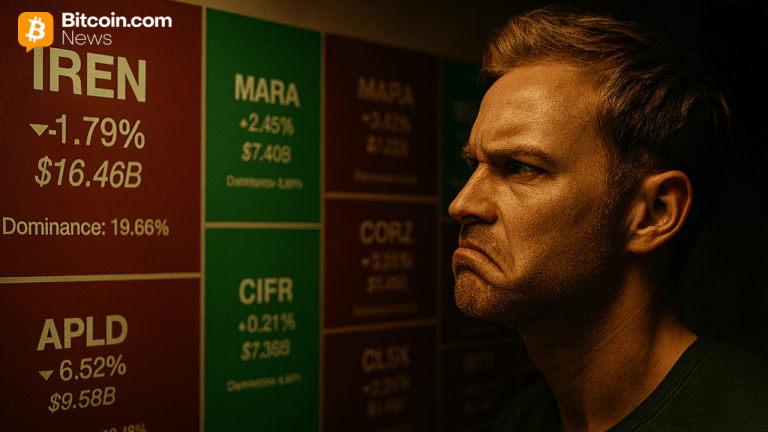

Bitcoin Mining and Treasury Firms Falter Together as BTC Drops 4.6% on the Week

NegativeCryptocurrency

This week, Bitcoin experienced a notable drop of 4.6%, impacting both mining and treasury firms heavily invested in the cryptocurrency. The decline raises concerns about the stability of the market and the financial health of these firms, which rely on Bitcoin's value for their operations. As the cryptocurrency landscape continues to fluctuate, this situation highlights the interconnectedness of various sectors within the crypto economy and the potential risks involved for investors.

— Curated by the World Pulse Now AI Editorial System