Dogecoin Faces Heavy Selling Pressure but Technical Setup Hints at Possible $1 Surge

NeutralCryptocurrency

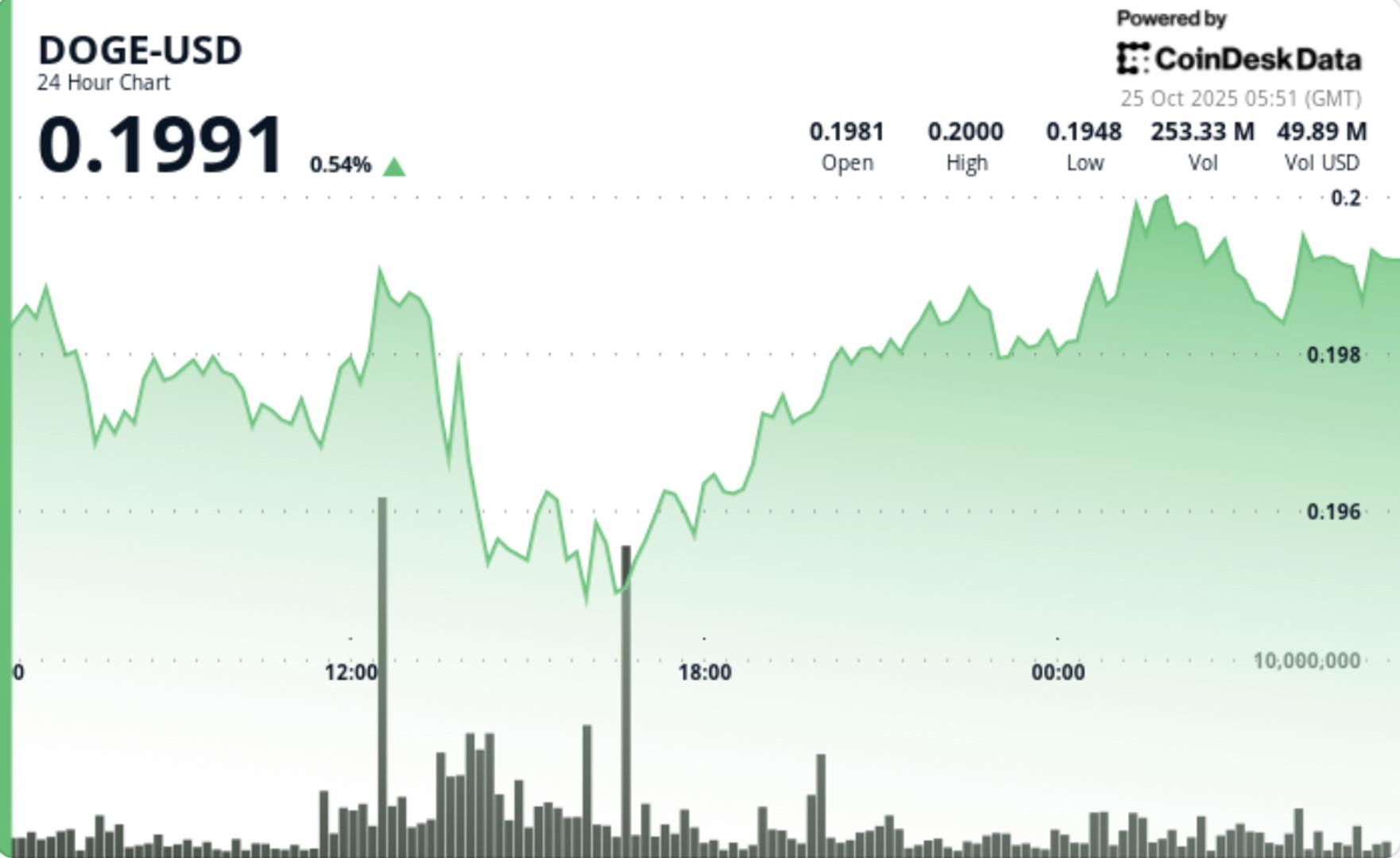

Dogecoin is currently experiencing significant selling pressure, having dropped 30% from its September highs. Despite this downturn, some technical indicators suggest that a rebound to the $1 mark could be possible. This situation is noteworthy as it highlights the volatility of meme-coins and the potential for recovery even in challenging market conditions.

— Curated by the World Pulse Now AI Editorial System