BTC, ETH, XRP, SOL Face Slow Bottoming Process After $16B Liquidation Shock

NegativeCryptocurrency

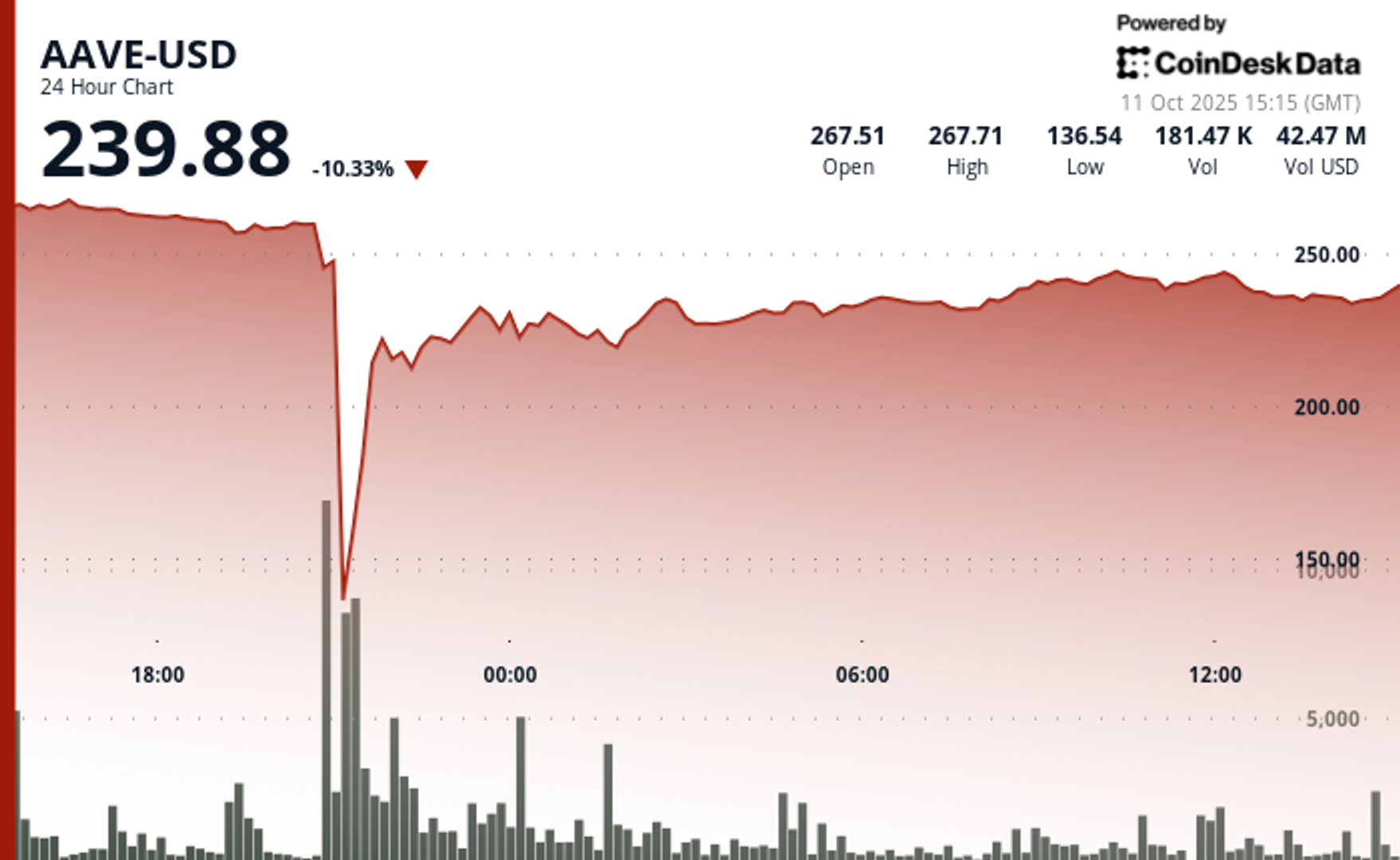

The cryptocurrency market is currently experiencing a slow bottoming process following a staggering $16 billion liquidation event. This significant downturn has affected major cryptocurrencies like Bitcoin, Ethereum, XRP, and Solana, leading to increased volatility and uncertainty among investors. Understanding this trend is crucial as it highlights the challenges the market faces and the potential for future recovery or further decline.

— Curated by the World Pulse Now AI Editorial System