Norwegian Officials Probe Major Polymarket Bets on Nobel Peace Winner

NeutralCryptocurrency

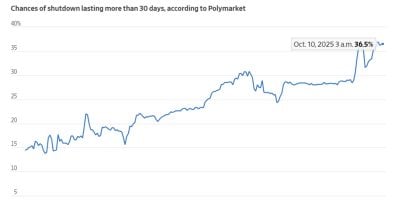

Norwegian officials are investigating significant bets placed on Polymarket regarding the winner of the Nobel Peace Prize. This inquiry raises questions about the integrity of betting markets and their influence on public perception of award outcomes. As the Nobel Prize is a prestigious recognition, the implications of such betting activities could affect how nominees are viewed and the overall credibility of the award.

— Curated by the World Pulse Now AI Editorial System