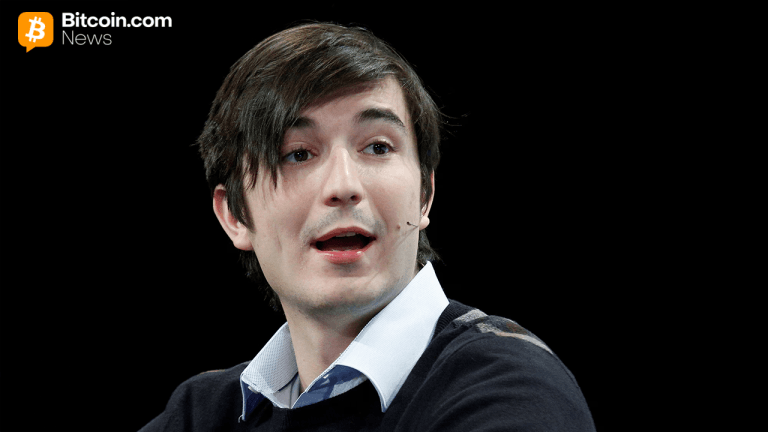

Bankman-Fried says his biggest mistake was handing FTX to new CEO before bankruptcy

NegativeCryptocurrency

Sam Bankman-Fried has expressed regret over his decision to hand over control of FTX to its current CEO before the company's bankruptcy. He believes this move was his biggest mistake, which ultimately hindered his ability to save the exchange. This revelation is significant as it sheds light on the internal struggles and decisions that led to the downfall of one of the largest cryptocurrency exchanges, raising questions about leadership and accountability in the crypto industry.

— Curated by the World Pulse Now AI Editorial System