‘PSA: Tokenization Will Eat Finance,’ Robinhood CEO Posts After Token2049 Panel

PositiveCryptocurrency

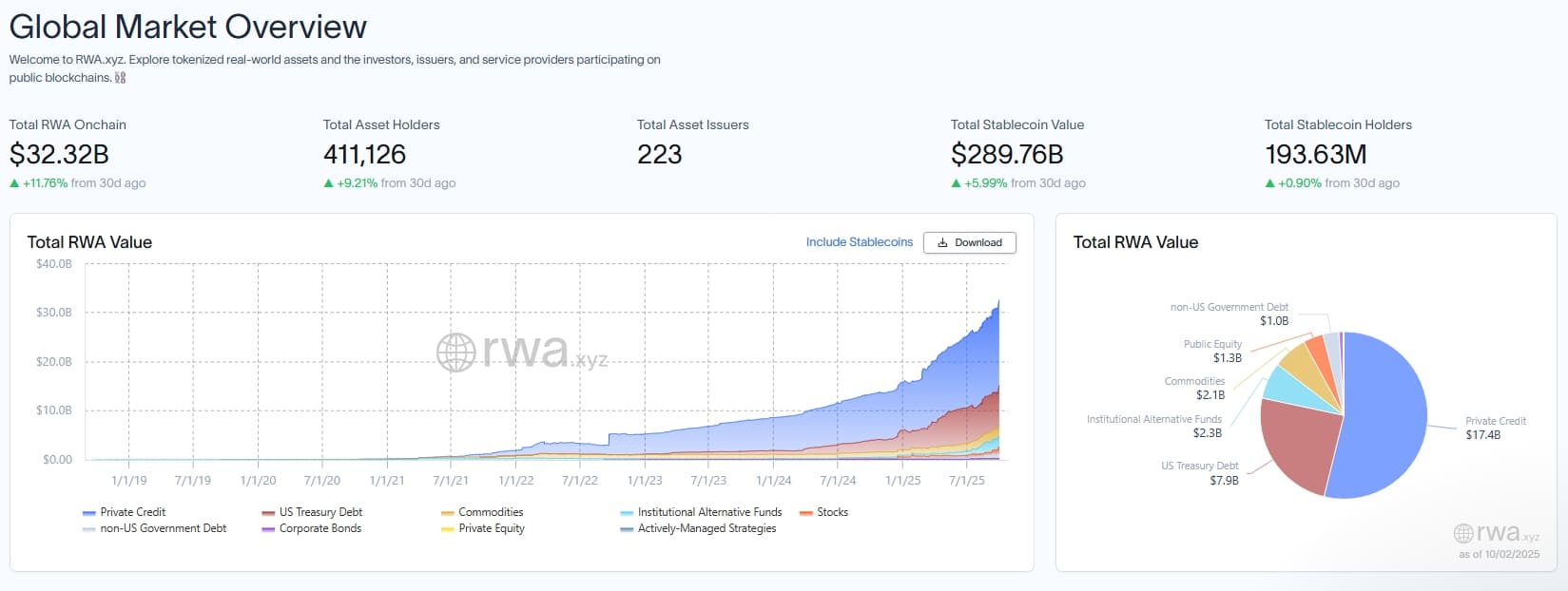

Robinhood's CEO recently emphasized the transformative potential of tokenization in finance during a panel at Token2049. This statement highlights a growing trend where digital assets are reshaping traditional financial systems, making transactions more efficient and accessible. As tokenization gains traction, it could revolutionize how we think about ownership and investment, making this a significant moment for both investors and the broader financial landscape.

— Curated by the World Pulse Now AI Editorial System