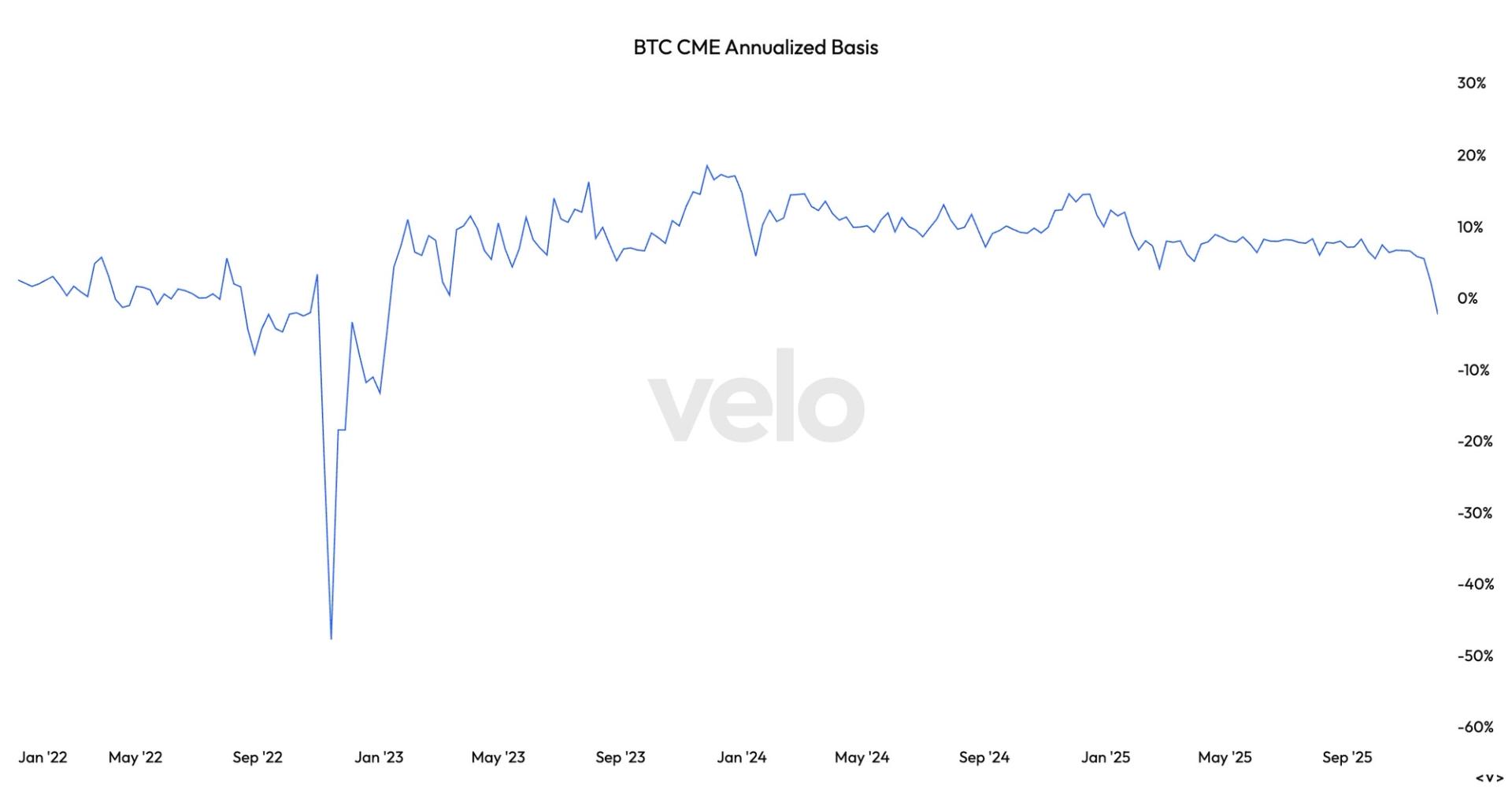

Bitcoin Futures Return to Deepest 'Backwardation' Since FTX Collapse Hinting Possible Bottom

NeutralCryptocurrency

- Bitcoin futures have returned to a state of deep backwardation, the most significant since the FTX collapse, indicating a potential market bottom as futures prices decline over time. This situation reflects heightened stress within the cryptocurrency market, particularly for Bitcoin, which has seen fluctuating prices recently.

- The return to backwardation suggests that investors may be anticipating further declines in Bitcoin's price, which could influence trading strategies and market sentiment. This development is crucial as it may signal a shift in investor confidence following the tumultuous events surrounding FTX.

- The current market dynamics are characterized by significant unrealized losses for traders, alongside concerns about Bitcoin's pricing relative to its fair value. Analysts are observing a tightening bull/bear line as Bitcoin hovers near production costs, raising questions about the cryptocurrency's valuation amidst broader economic pressures and investor sentiment.

— via World Pulse Now AI Editorial System