Will Somnia Data Streams Kill Chainlink Market Share? SOMI Price Prediction Q4?

PositiveCryptocurrency

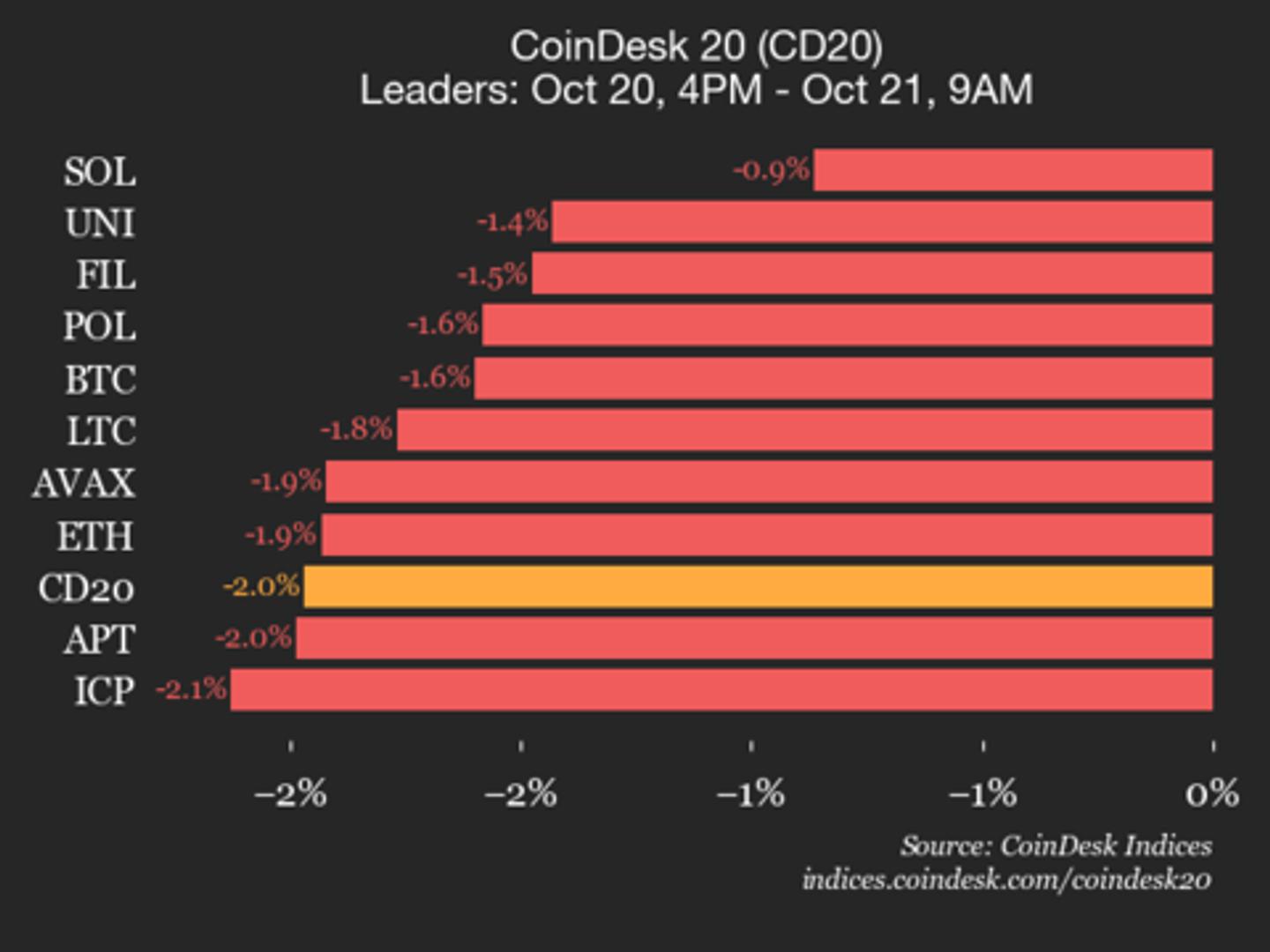

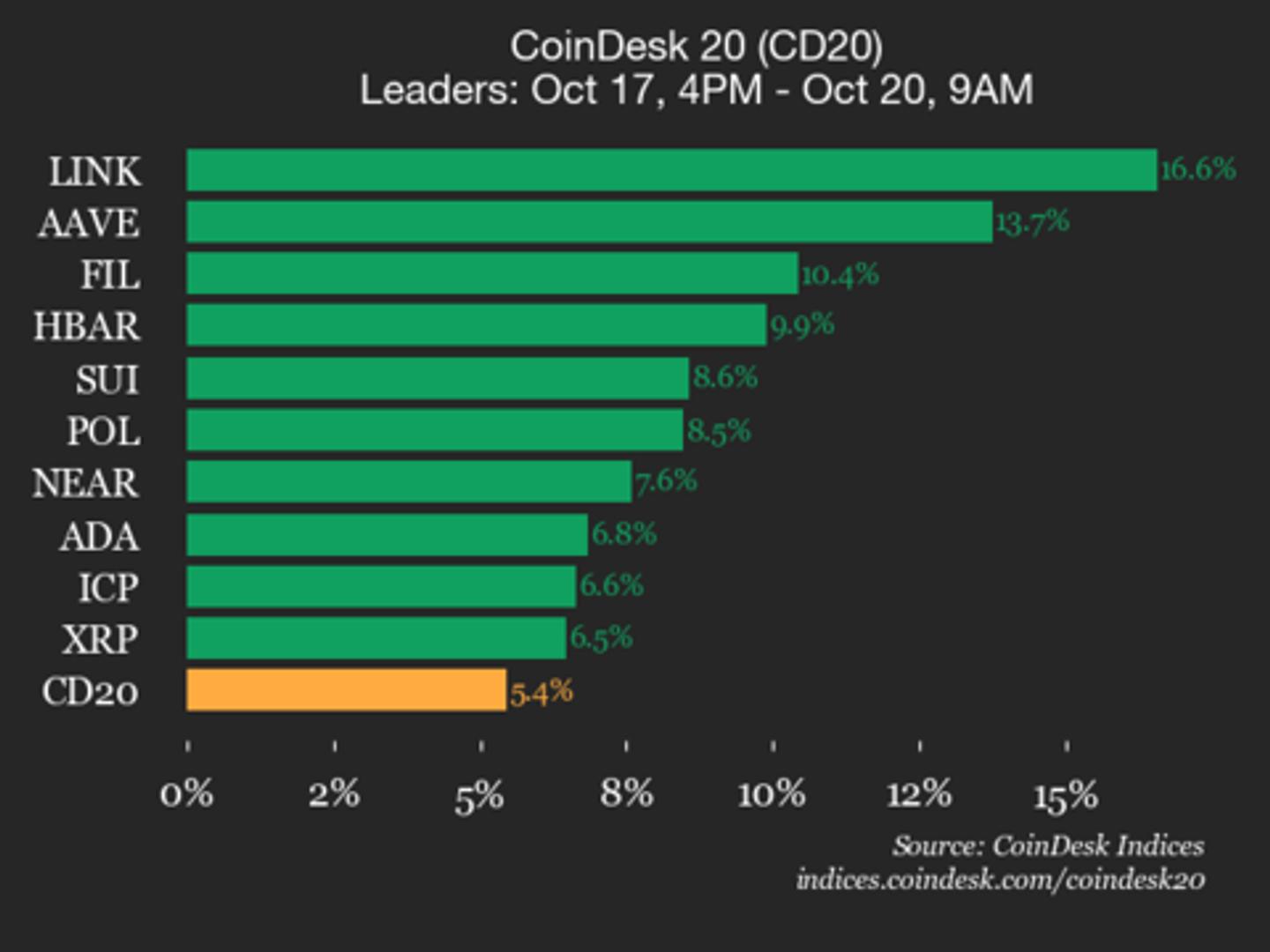

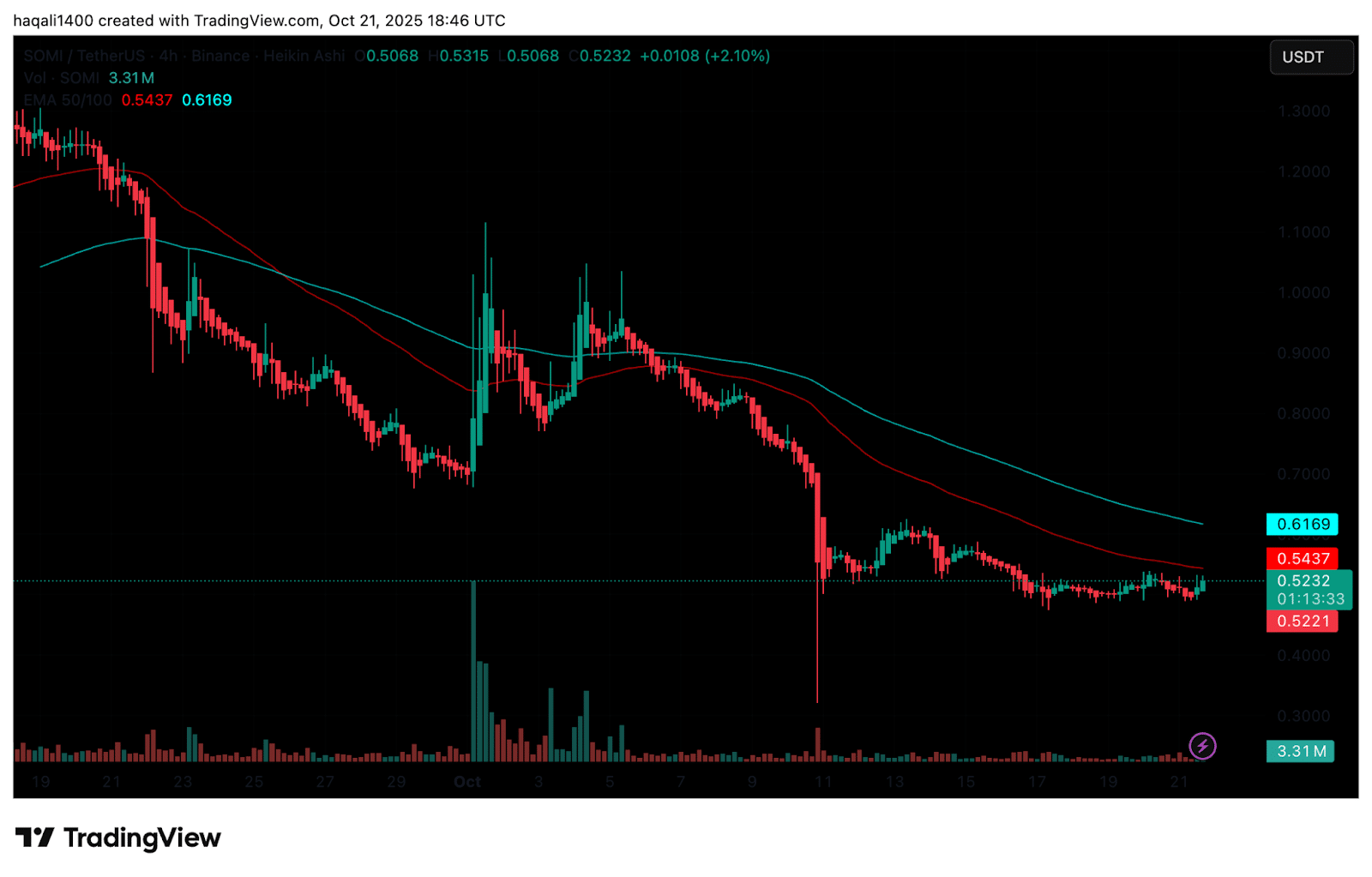

Somnia crypto is shaking up the blockchain world with its new Data Streams feature, which allows applications to receive live updates on on-chain transactions. This innovation could potentially challenge established players like Chainlink, making it a significant development in the crypto space. As we look ahead to Q4 2025, the implications for SOMI's price are intriguing, and investors are keen to see how this technology will evolve and impact the market.

— Curated by the World Pulse Now AI Editorial System