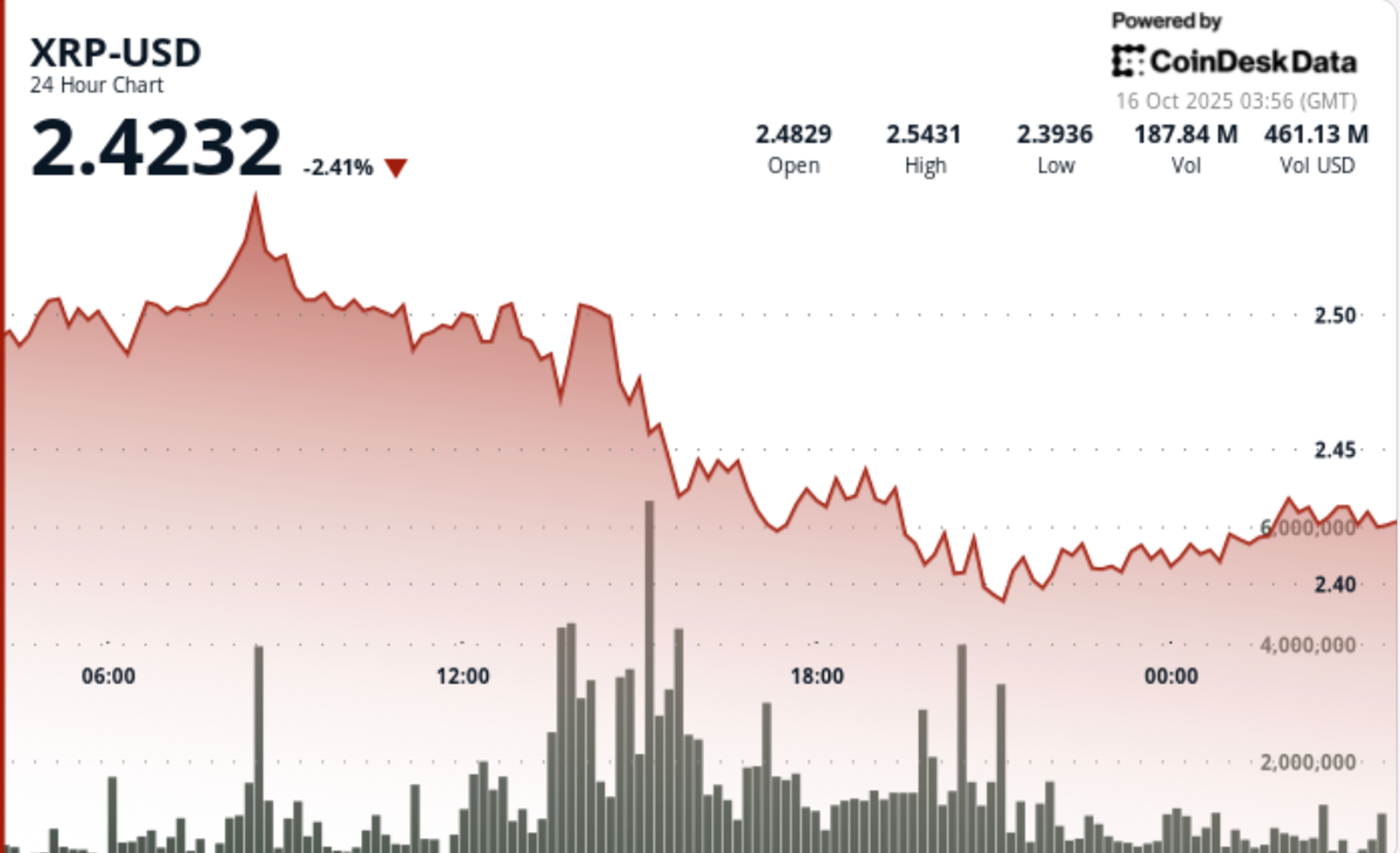

XRP Price Coils Below Resistance — Bulls Prepare For Possible Upside Explosion

PositiveCryptocurrency

XRP is currently in a consolidation phase below $2.60, showing promising signs for a potential upward movement. With resistance levels at $2.50 and $2.60, traders are closely watching for a breakout. If XRP can surpass these levels, it could lead to a significant price surge, making it an exciting time for investors. This situation is crucial as it indicates the market's sentiment and potential future trends for XRP.

— Curated by the World Pulse Now AI Editorial System