As US Pressure Against Venezuela Builds, Polymarket Bettors Handicap Maduro’s Exit Timing

NegativeCryptocurrency

- As U.S. pressure against Venezuela intensifies, bettors on Polymarket are speculating on the timing of President Nicolás Maduro's exit from power. The prediction market reflects a negative sentiment regarding the political climate in Venezuela, influenced by external factors such as U.S. sanctions and diplomatic efforts.

- This development is significant as it highlights the uncertainty surrounding Maduro's regime and the potential for political change in Venezuela, which could have far-reaching implications for the country's future and its relations with the U.S.

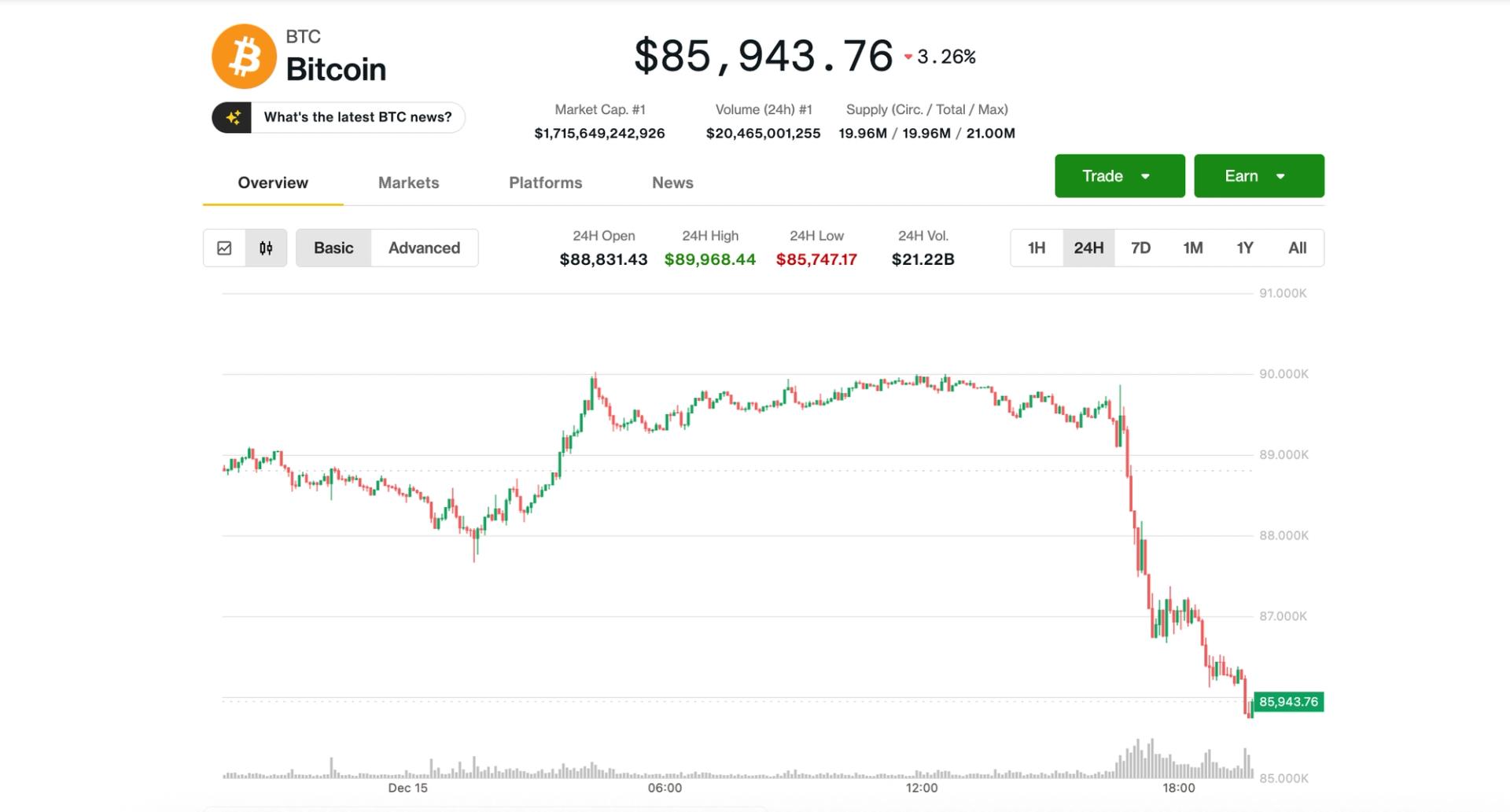

- The situation also mirrors broader trends in cryptocurrency prediction markets, where fluctuating investor sentiment is evident. Recent odds on platforms like Polymarket indicate mixed expectations for Bitcoin's performance, suggesting a cautious outlook amid ongoing geopolitical tensions and market volatility.

— via World Pulse Now AI Editorial System