Asia Morning Briefing: Polymarket Bettors Still Expect Big Strategy Buys Even as Saylor Prepares for a Weak Market

NeutralCryptocurrency

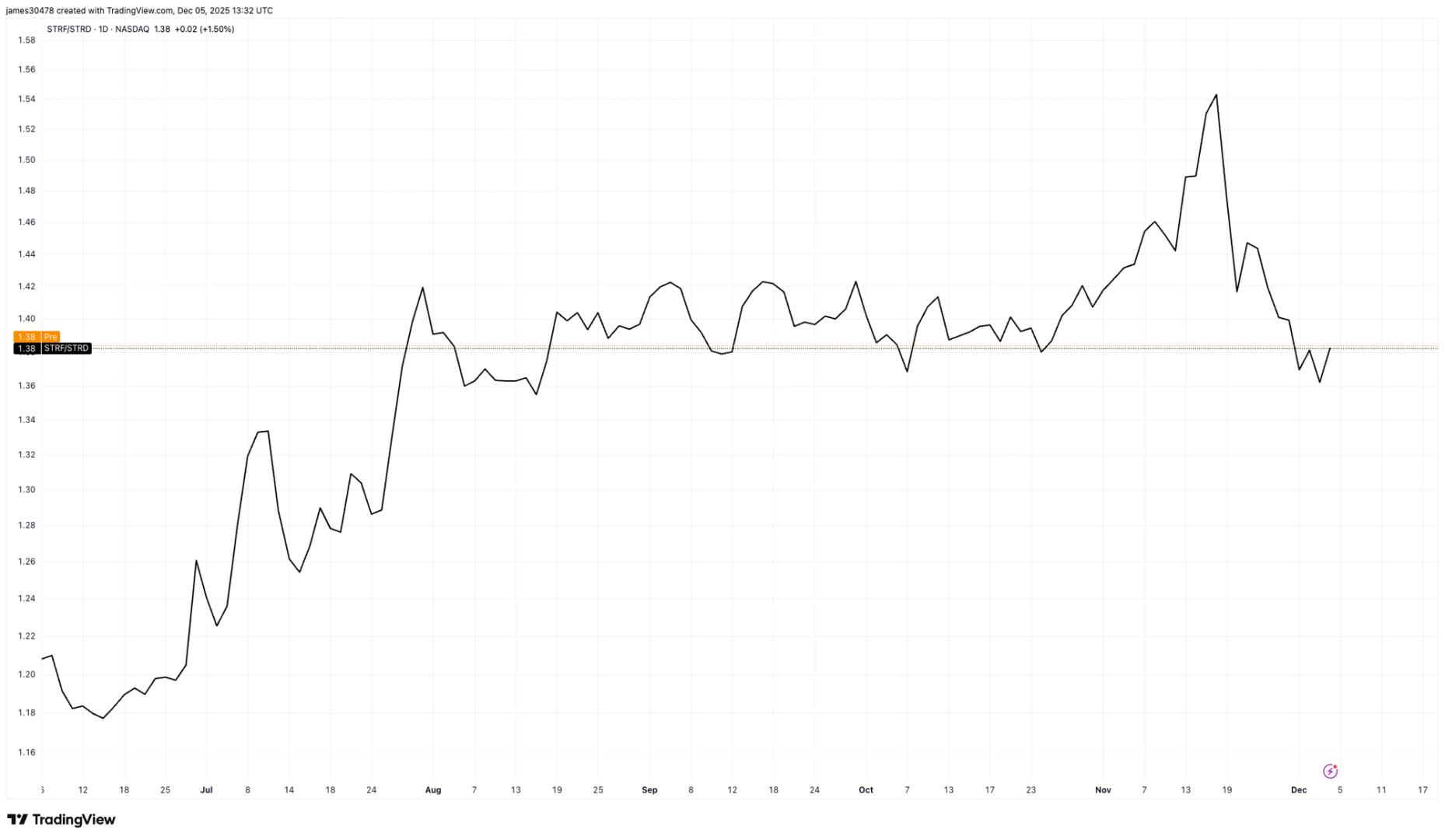

- Polymarket bettors are maintaining expectations for significant strategic acquisitions despite Michael Saylor's preparations for a potentially weak market. This sentiment reflects ongoing confidence in the cryptocurrency sector amid fluctuating market conditions.

- The developments are crucial for Saylor and his company, Strategy, which is facing challenges including stock price declines and potential exclusion from MSCI indices. Saylor's commitment to Bitcoin remains strong, indicating a strategic focus on long-term growth despite short-term volatility.

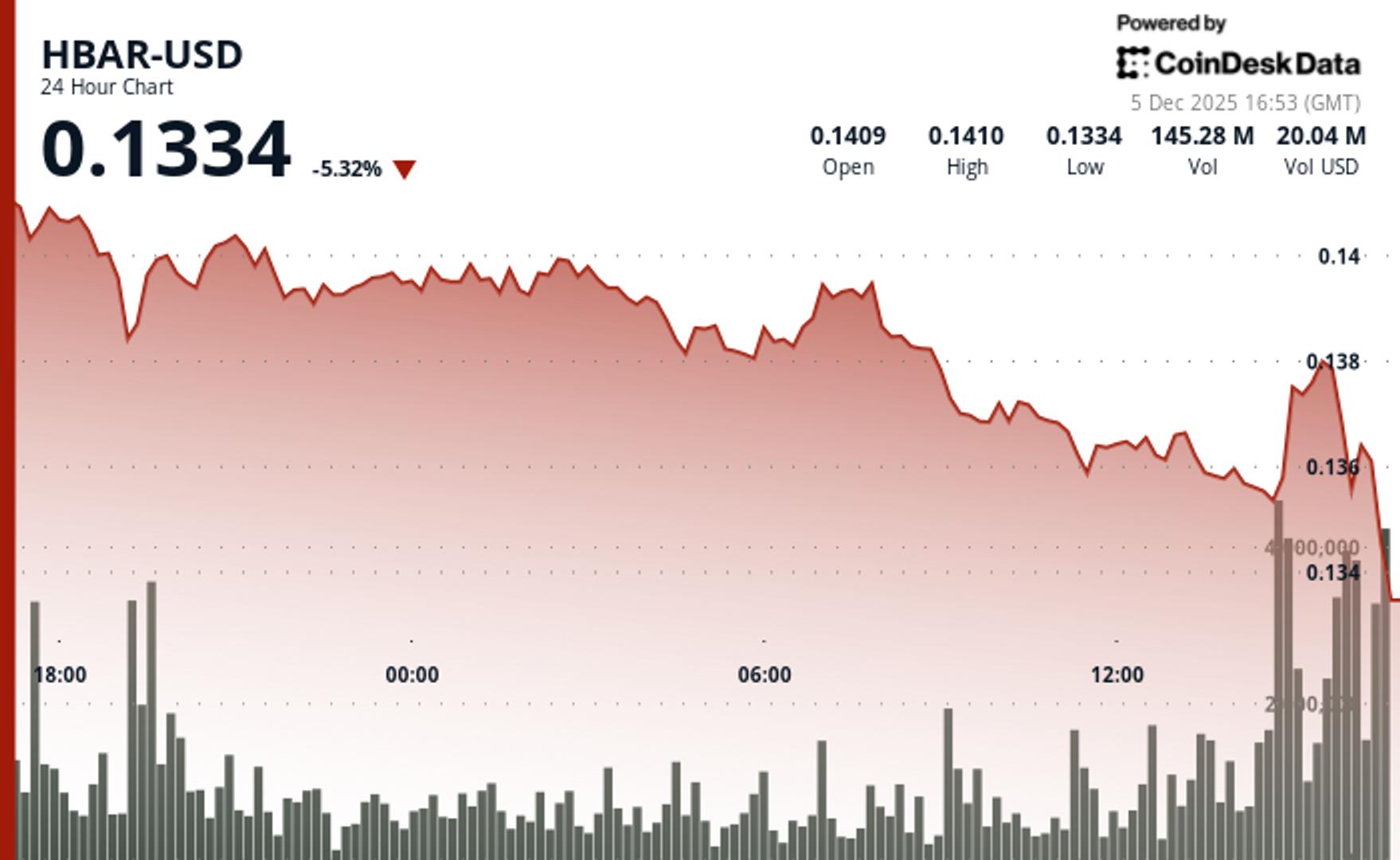

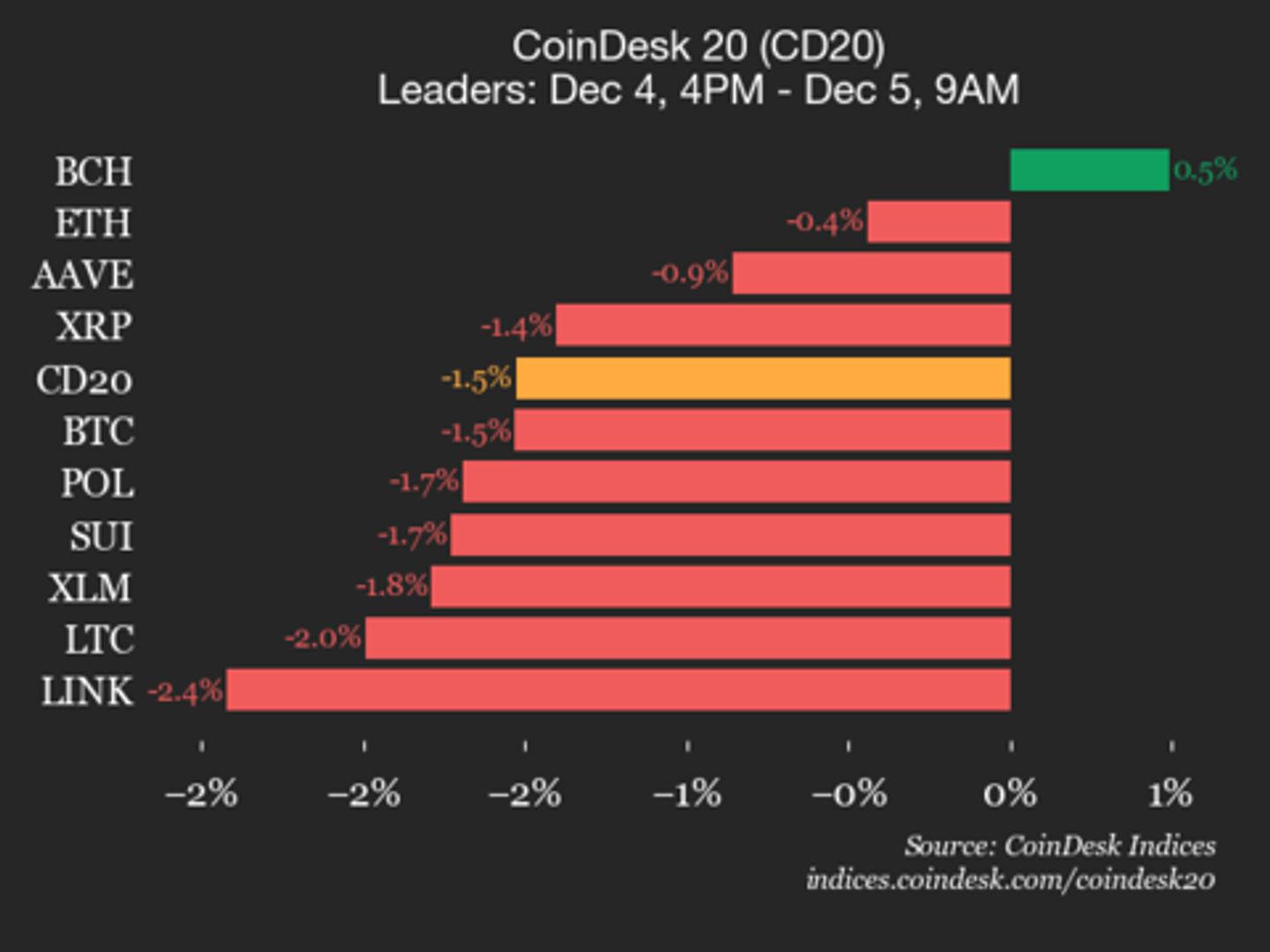

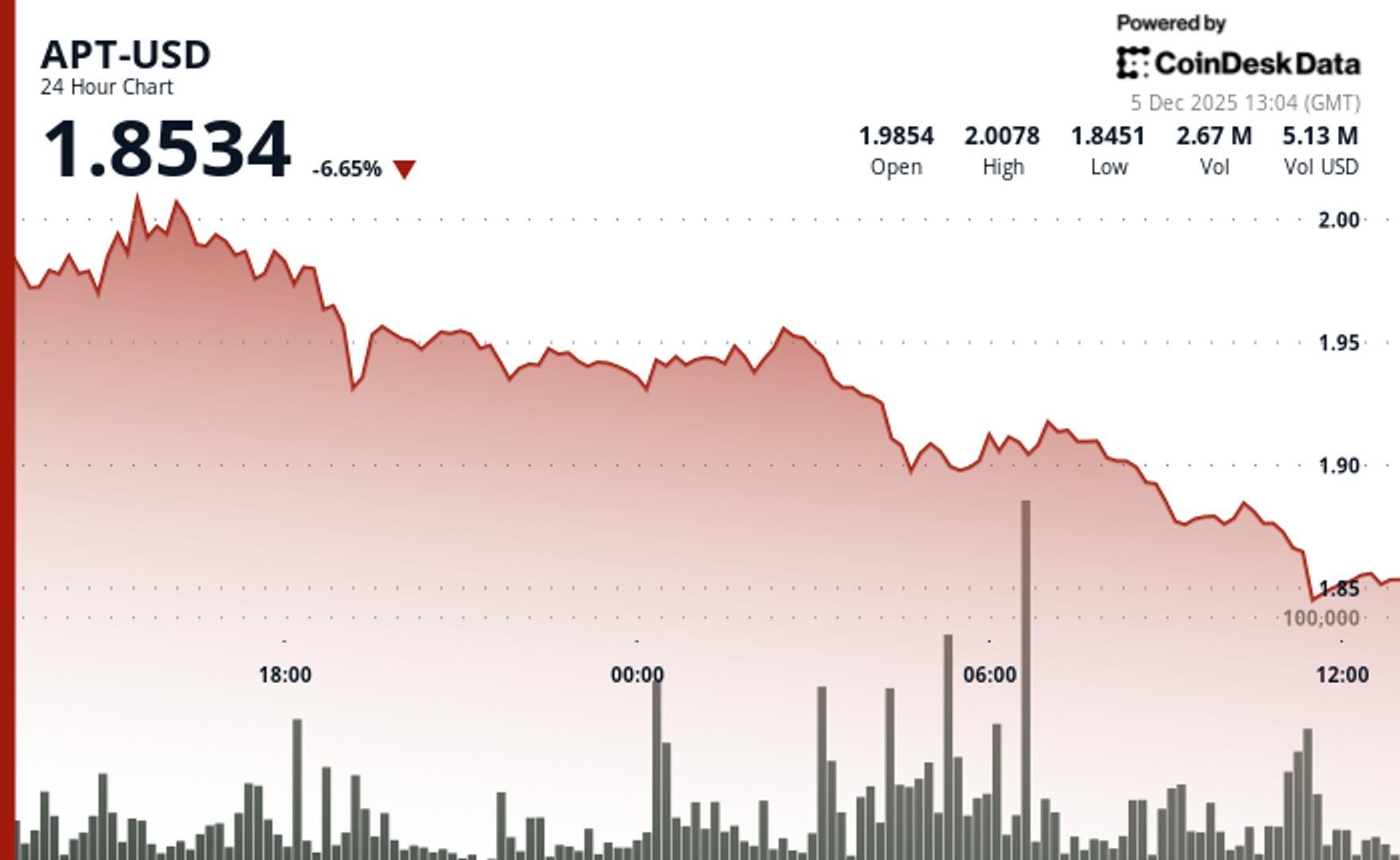

- The cryptocurrency market is currently experiencing significant volatility, with Bitcoin's price fluctuating around $86,000. This situation highlights broader investor concerns and mixed sentiments regarding future price movements, particularly as Polymarket indicates a high probability of a U.S. rate cut, which could influence market dynamics.

— via World Pulse Now AI Editorial System