BlackRock exec says ‘perfectly normal’ as IBIT sees $2.3B outflows in Nov

NeutralCryptocurrency

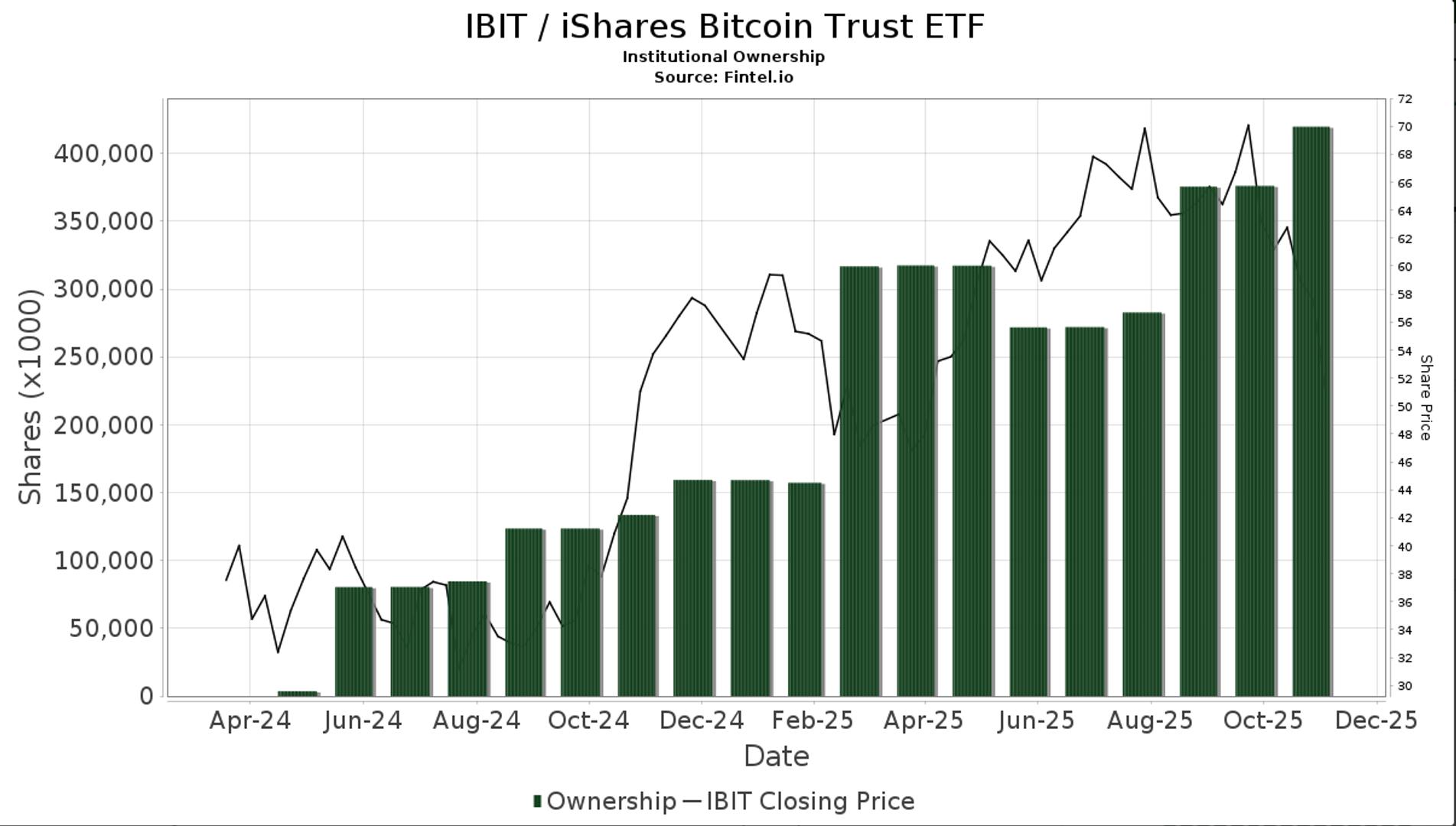

- BlackRock reported $2.34 billion in outflows from its iShares Bitcoin Trust (IBIT) in November, which the company described as a normal occurrence given the previous demand that had pushed the ETF close to $100 billion in assets.

- This significant outflow reflects a cautious sentiment among investors, likely influenced by recent market volatility and declining Bitcoin prices, which may impact BlackRock's standing in the cryptocurrency sector and investor confidence in its products.

- The trend of substantial withdrawals from BlackRock's Bitcoin ETF aligns with a broader pattern of investor caution in the cryptocurrency market, as fears of a potential bear market and ongoing volatility have led to significant outflows across various Bitcoin ETFs, indicating a shift in investor strategies and confidence.

— via World Pulse Now AI Editorial System