Aptos Rises 8% After Breaking Through $1.80 Resistance

PositiveCryptocurrency

- Aptos (APT) has seen a notable rise of 8% after successfully breaking through the $1.80 resistance level, characterized by strong trading volume and positive technical momentum. This increase marks a significant recovery for the token, which had faced recent challenges in the market.

- The upward movement in APT's value is crucial as it reflects renewed investor confidence and a potential shift in market sentiment, especially after previous declines that saw the token drop to $1.85 due to technical breakdowns.

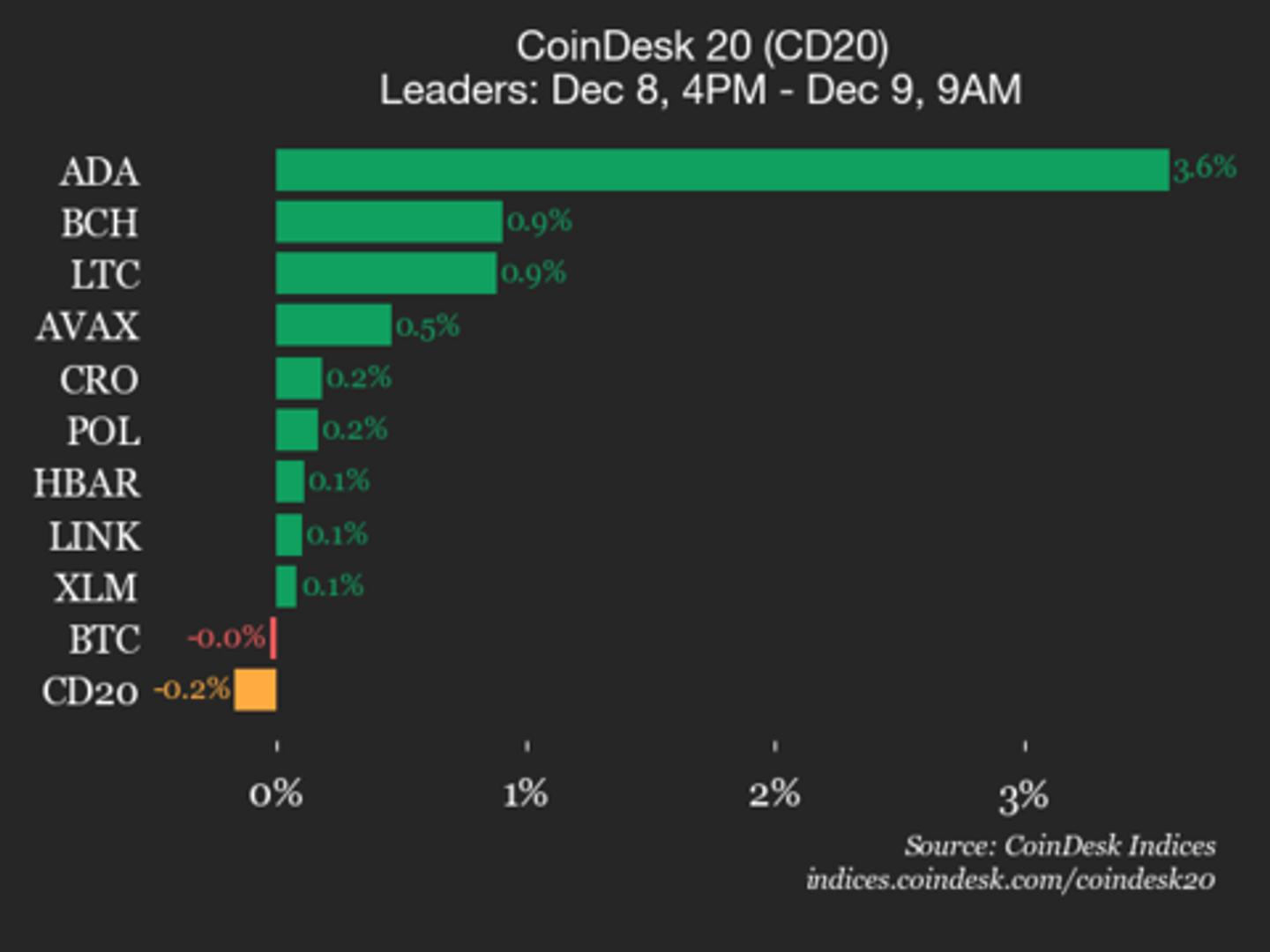

- This development aligns with a broader trend in the cryptocurrency market, where several tokens, including Polkadot and AAVE, have also experienced significant gains after breaking key resistance levels, indicating a potential resurgence in market activity and investor interest across various cryptocurrencies.

— via World Pulse Now AI Editorial System