Dogecoin Surges as Ether Zooms 8%, Sparking Bullish Reversal For Memecoins

PositiveCryptocurrency

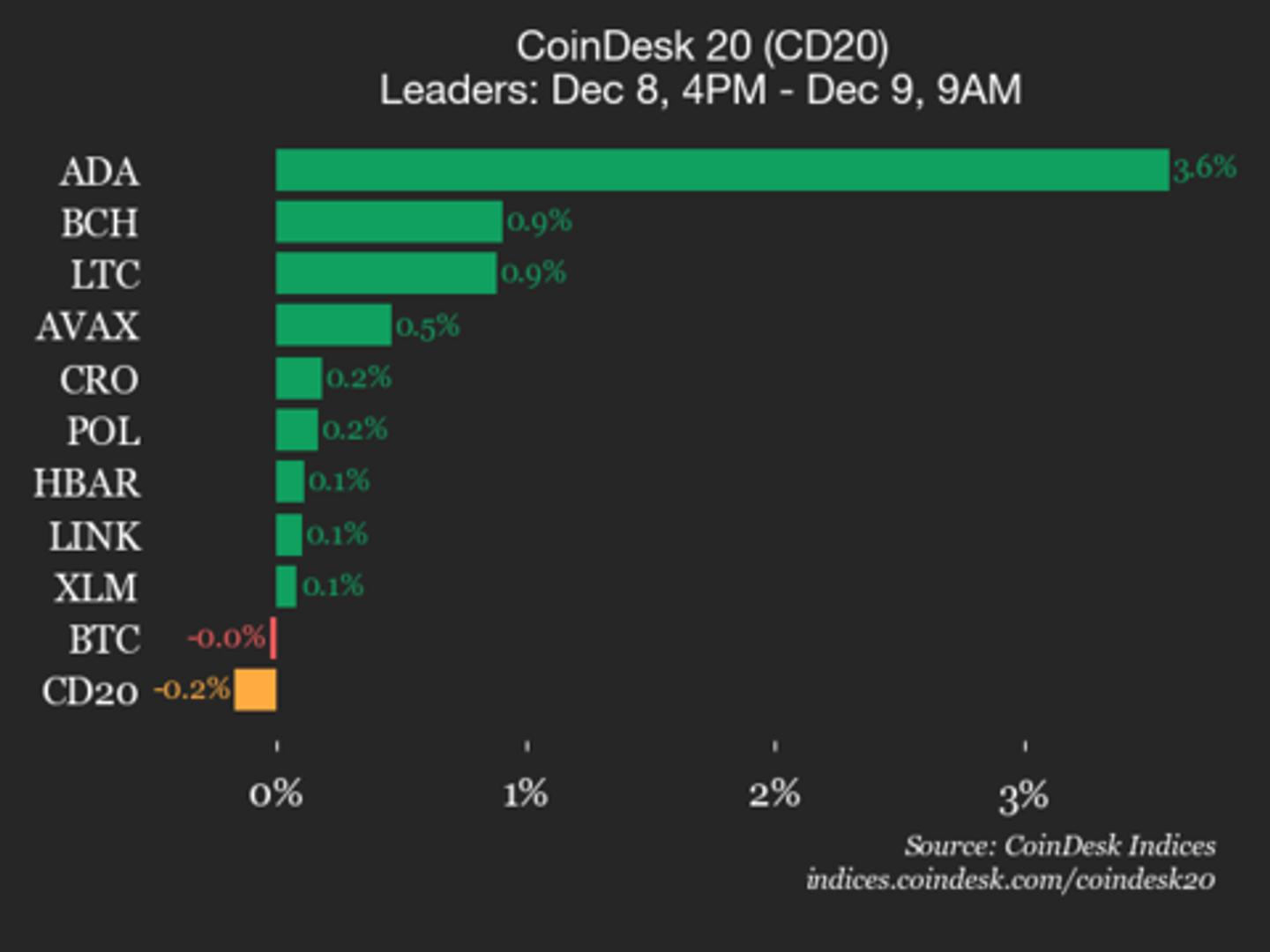

- Dogecoin has experienced a notable surge alongside Ether, which has risen by 8%, indicating a potential bullish reversal for memecoins. This breakout has established a continuation zone, contingent on bulls maintaining the mid

- The recent price movements are significant for Dogecoin as they suggest a shift in market sentiment, with traders increasingly optimistic about the cryptocurrency's potential for recovery and growth. This could attract more retail investors and bolster trading volumes.

- The broader cryptocurrency market is witnessing a tightening structure, with key metrics indicating a shift towards accumulation among larger holders. This trend, coupled with a decrease in whale activity, suggests a more stable market environment, potentially paving the way for further bullish developments in the coming weeks.

— via World Pulse Now AI Editorial System