Why is Bitcoin near all-time highs? Everything that happened in crypto today

PositiveCryptocurrency

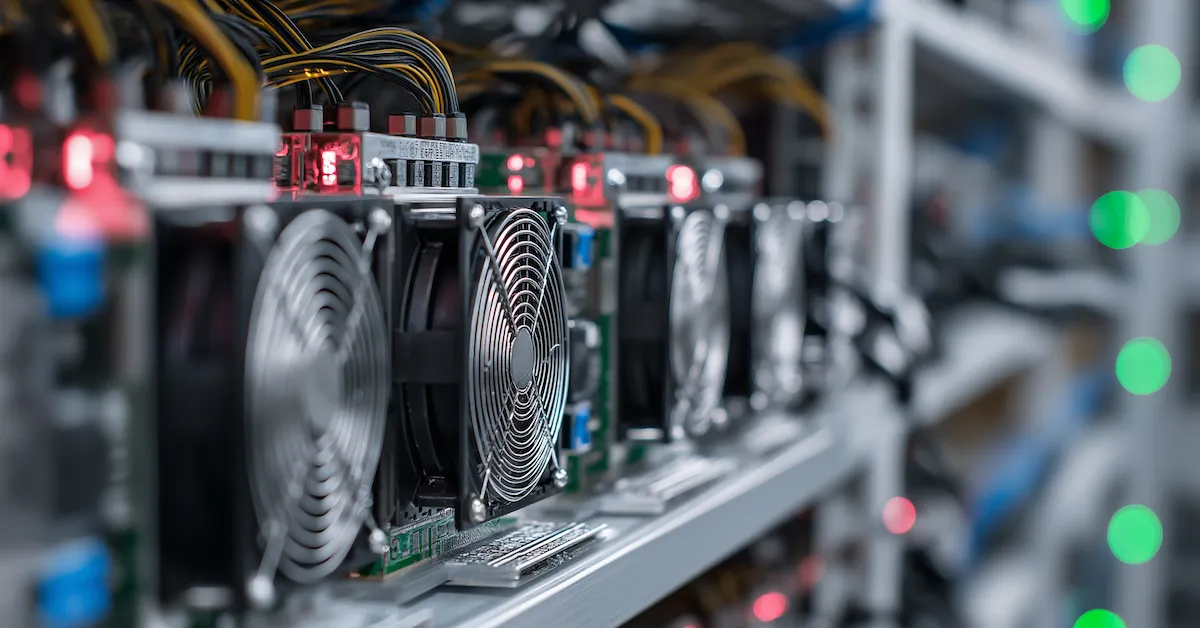

Bitcoin is currently trading near its all-time high of $124,000, reaching $120,367.71, thanks to expectations of a Federal Reserve rate cut and a reset in market structure. Softer labor signals from the U.S. and concerns over a potential government shutdown have traders optimistic about another rate cut this month, which is boosting risk assets like Bitcoin. This surge is significant as it reflects growing confidence in the cryptocurrency market and could lead to further investments in digital assets.

— Curated by the World Pulse Now AI Editorial System