Crypto.com CEO calls for probe into exchanges after $20B liquidations

PositiveCryptocurrency

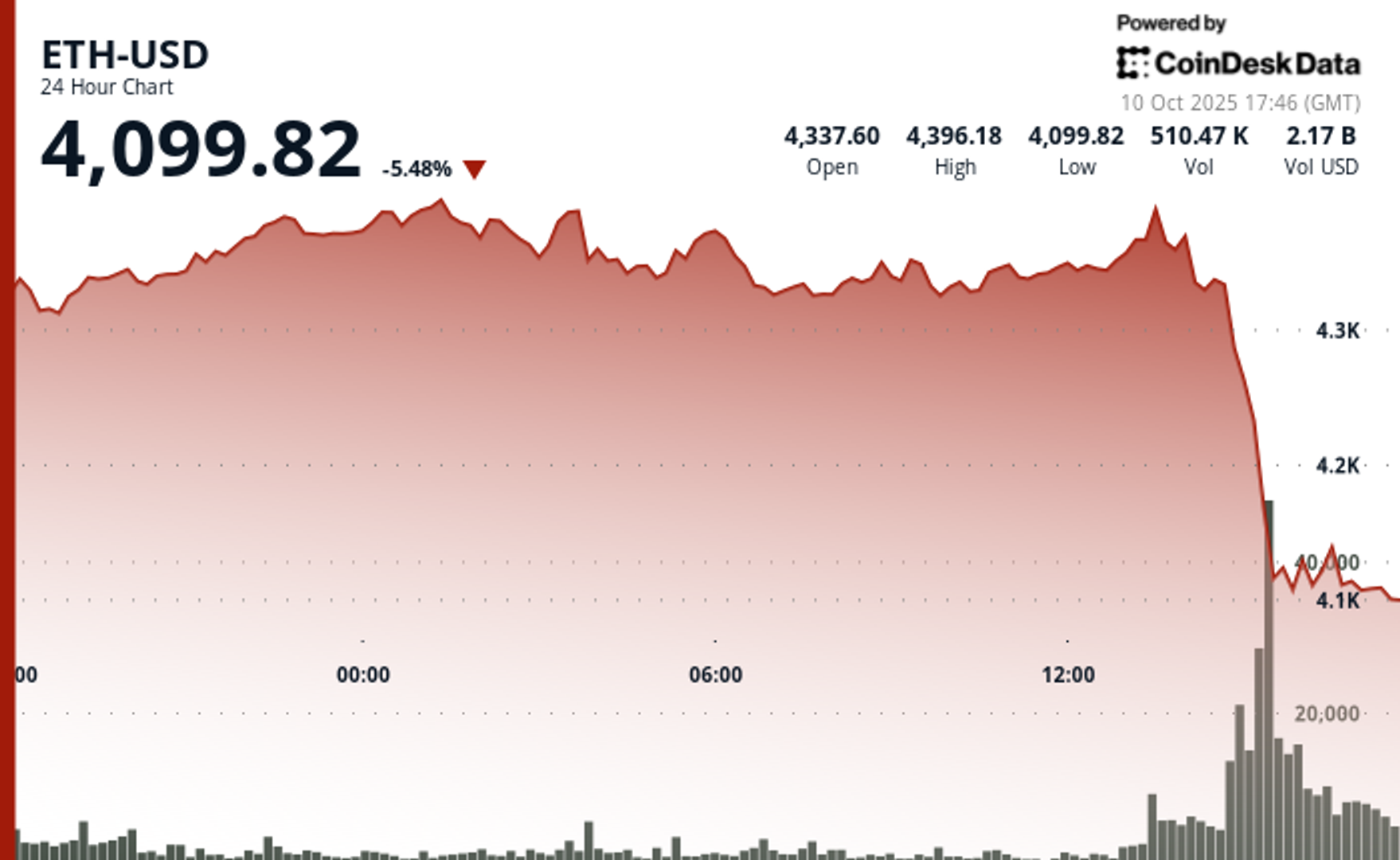

Crypto.com CEO Kris Marszalek is calling for a regulatory investigation into cryptocurrency exchanges following a staggering $20 billion in liquidations. This significant event surpasses previous market crashes, including the infamous FTX collapse. Marszalek's push for scrutiny highlights the need for greater oversight in the crypto space, which could lead to more stability and trust among investors. As the market continues to evolve, such calls for accountability are crucial for protecting users and ensuring a healthier trading environment.

— Curated by the World Pulse Now AI Editorial System