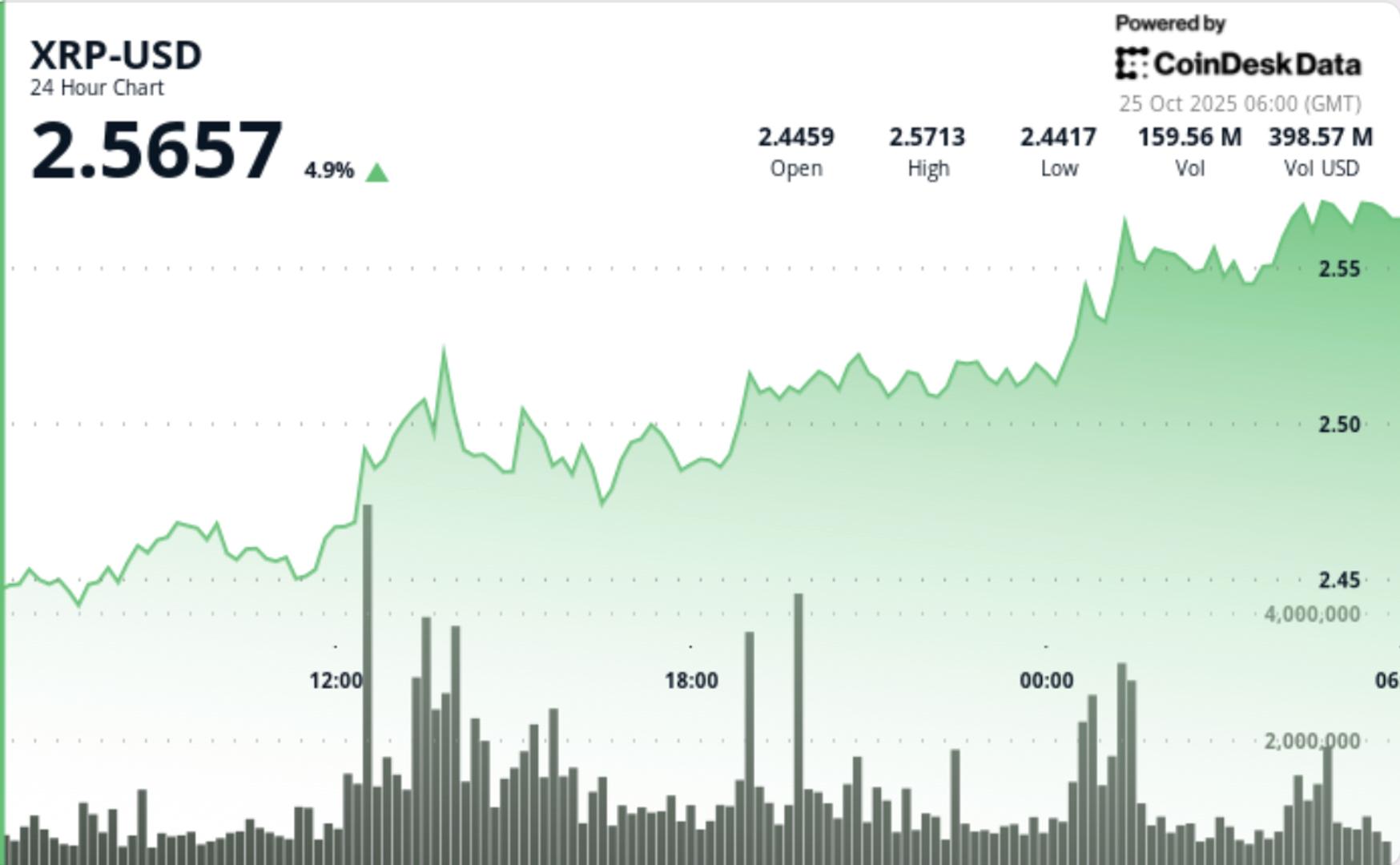

XRP Leads Gains on Ripple Moves, Bitcoin Holds $111K as ‘Uptober’ Dud Heads for Last Week

PositiveCryptocurrency

XRP is making headlines as it leads the gains in the cryptocurrency market, driven by recent moves from Ripple. Meanwhile, Bitcoin is maintaining its value at $111K, despite some skepticism surrounding the so-called 'Uptober' trend. This is significant as it highlights the resilience of XRP and the overall market's performance, suggesting a potential shift in investor confidence.

— Curated by the World Pulse Now AI Editorial System