XRP price on edge as Ripple USD hits $900m milestone

PositiveCryptocurrency

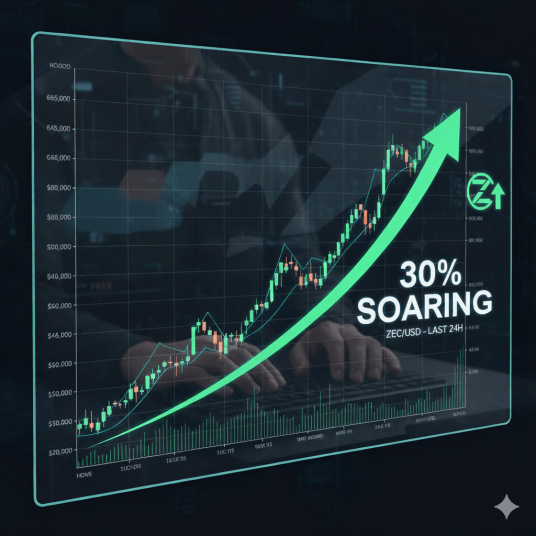

XRP is experiencing a notable price rally, recently reaching a high of $2.6340, the highest since October 11. This surge comes as Ripple USD hits a significant milestone with a market cap of $900 million and increased ETF inflows. The strong fundamentals behind Ripple suggest that despite facing resistance at the 50-day moving average, the outlook remains optimistic for investors and the broader cryptocurrency market.

— Curated by the World Pulse Now AI Editorial System