Altcoin Rally Alert: 4 Bullish Signals To Watch Out For – Analyst

PositiveCryptocurrency

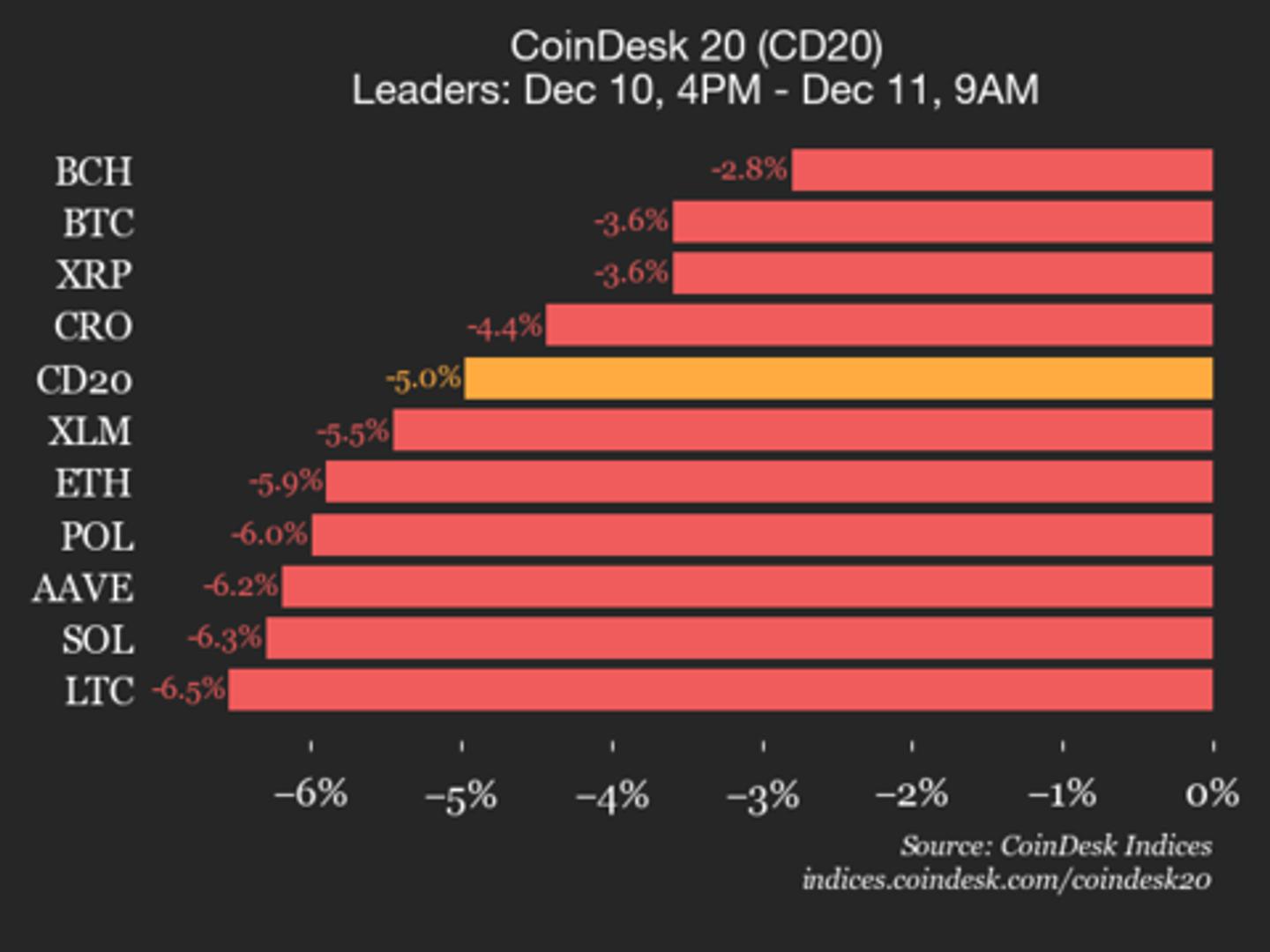

- Prominent market analyst Michael Van de Poppe has identified four key market conditions that could signal an altcoin rally, as the cryptocurrency market faces a widespread correction affecting asset prices. Ethereum has shown resilience, outperforming Bitcoin recently, which is seen as a positive indicator for altcoins.

- The performance of Ethereum relative to Bitcoin is crucial for altcoin investors, as it can boost confidence and trading activity in the broader cryptocurrency market. A breakthrough in Bitcoin's price above $92,000 is among the conditions that could trigger a more significant altcoin market rally.

- The recent recovery in Bitcoin's price, reclaiming the $93,000 mark, reflects a shift in market sentiment, with altcoins also experiencing positive movements. This broader market recovery suggests a potential turning point, as Ethereum's strength and whale activity indicate growing demand, which may lead to further bullish trends in the altcoin sector.

— via World Pulse Now AI Editorial System