Crypto Biz: 'Sound money' meets a sound beating as Binance pledges bailout

PositiveCryptocurrency

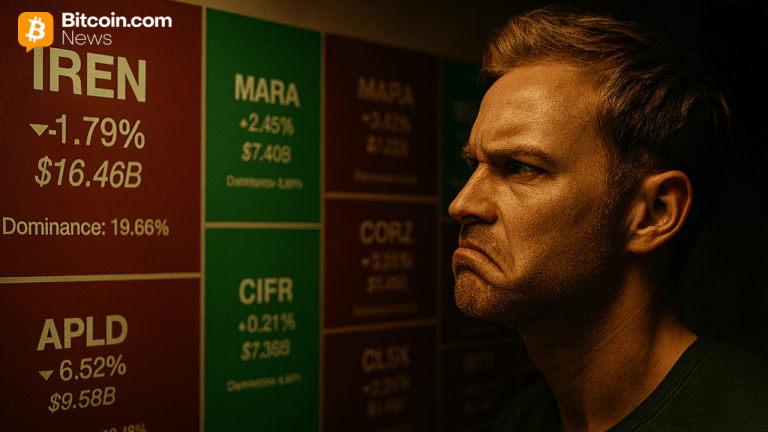

In a significant move for the cryptocurrency world, Binance has pledged a bailout to support the struggling crypto markets following a recent crash. This commitment comes as JP Morgan announces plans to offer crypto services, and major corporations are increasingly stacking Bitcoin. Notably, Elon Musk has expressed his support for Bitcoin, highlighting its potential as a 'sound money' alternative. This development is crucial as it reflects growing institutional interest and confidence in cryptocurrencies, which could stabilize the market and encourage further adoption.

— Curated by the World Pulse Now AI Editorial System