Bitcoin tumbles below $89,000, triggering over $200 million in long liquidations in past hour

NegativeCryptocurrency

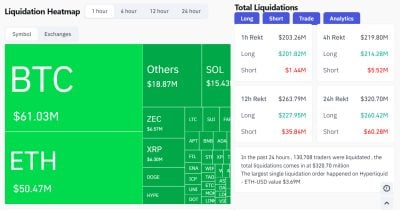

- Bitcoin's price has fallen below $89,000, resulting in over $200 million in long liquidations within the past hour, highlighting the extreme volatility of the cryptocurrency market. This decline follows a broader trend where Bitcoin has lost nearly 25% of its value in November, contributing to significant market instability.

- The recent price drop and subsequent liquidations may deter new investors from entering the cryptocurrency space, as the risks associated with such volatility become more apparent. This situation raises concerns about the overall health and stability of the market.

- The ongoing volatility is compounded by investor caution, as evidenced by substantial outflows from Bitcoin ETFs and predictions of further price declines. Analysts are observing patterns that suggest potential further downturns, while large holders, or whales, are adjusting their positions, indicating a complex interplay of market forces that could shape future trends.

— via World Pulse Now AI Editorial System