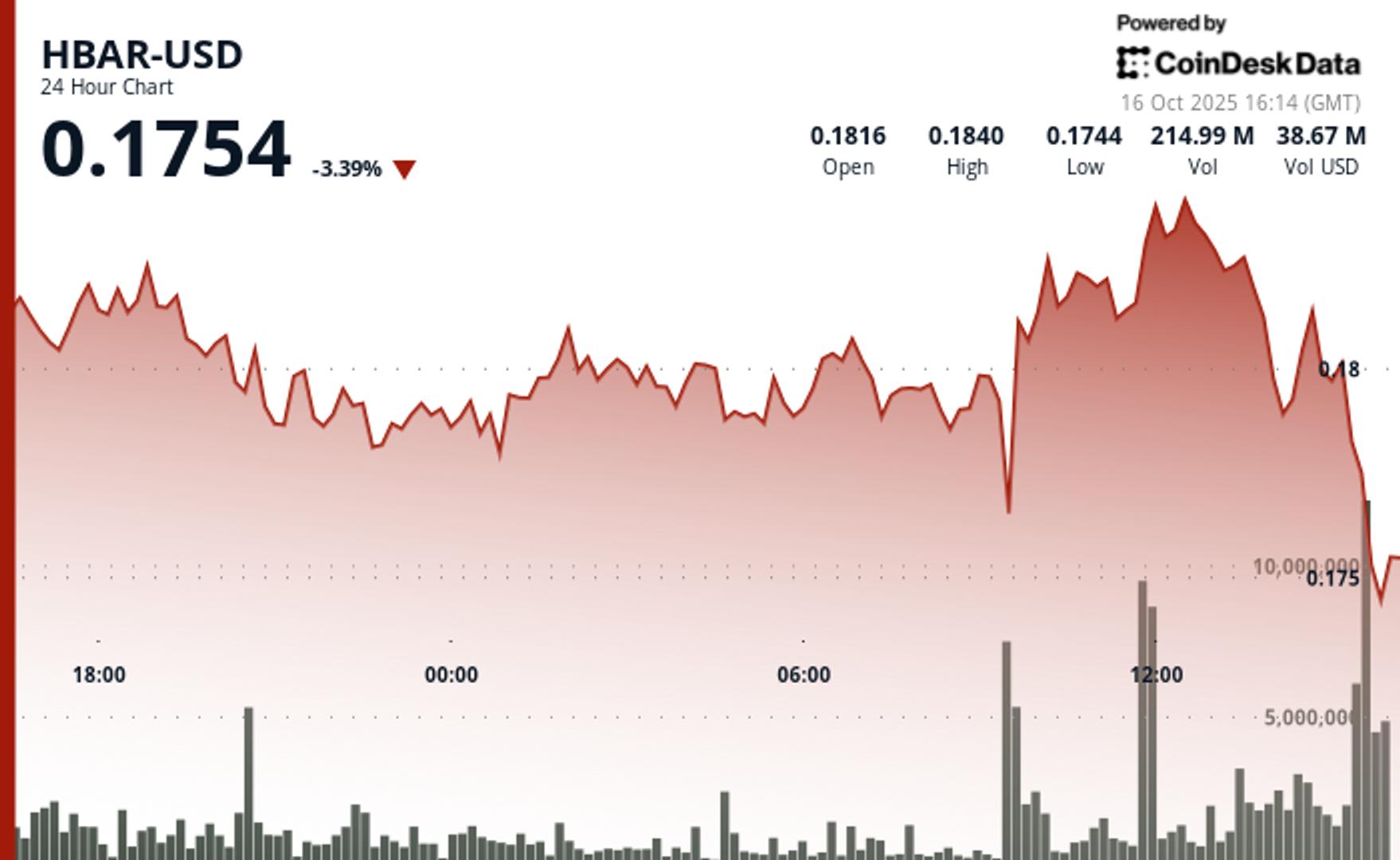

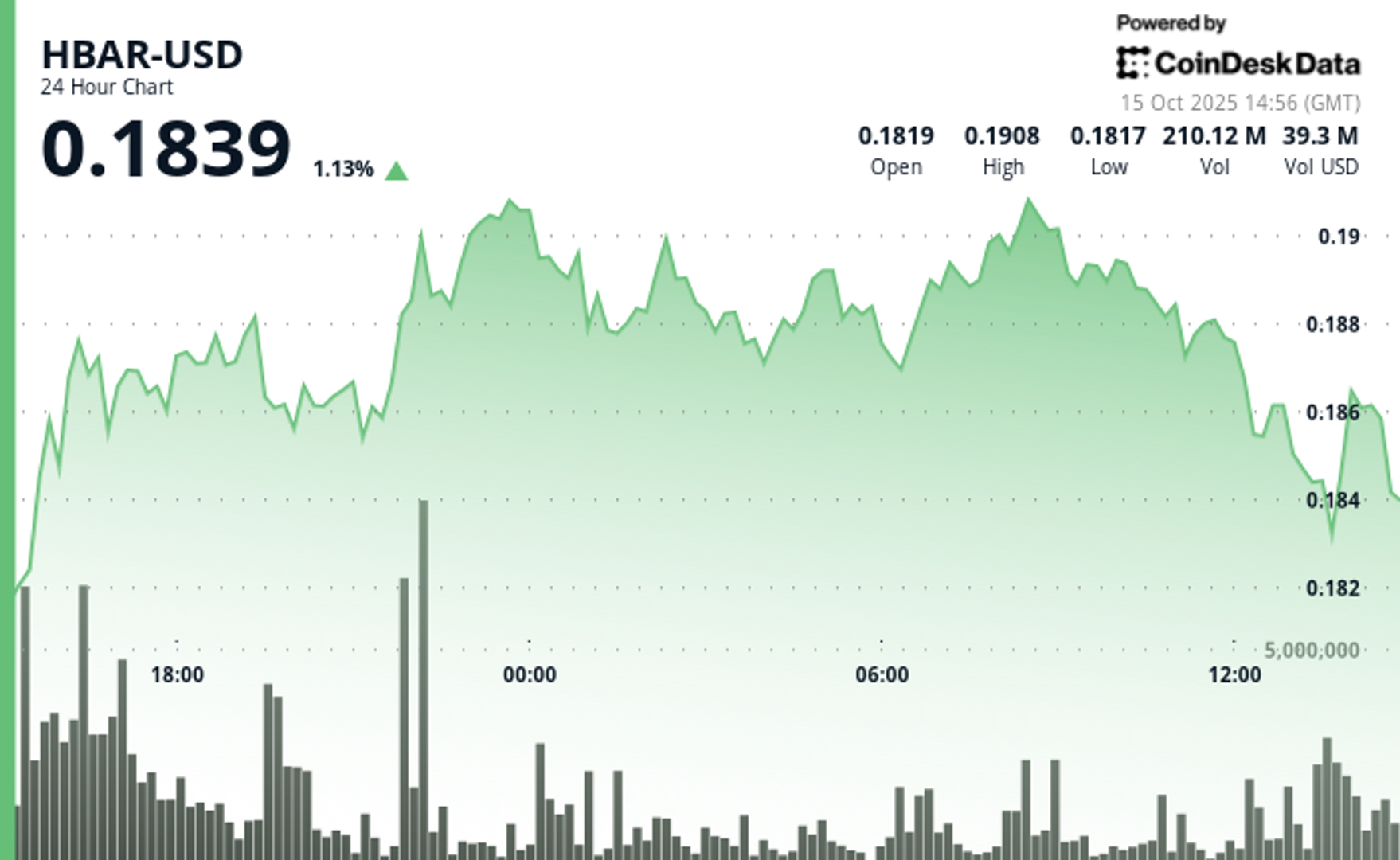

HBAR price to crash further amid Hedera ecosystem woes

NegativeCryptocurrency

The price of HBAR has plummeted nearly 50% since its peak in August, signaling a troubling bear market for the cryptocurrency. Weak fundamentals and technical indicators suggest that further declines are likely, raising concerns about the overall health of the Hedera ecosystem. This situation matters because it reflects broader issues within the cryptocurrency market and could impact investor confidence.

— Curated by the World Pulse Now AI Editorial System